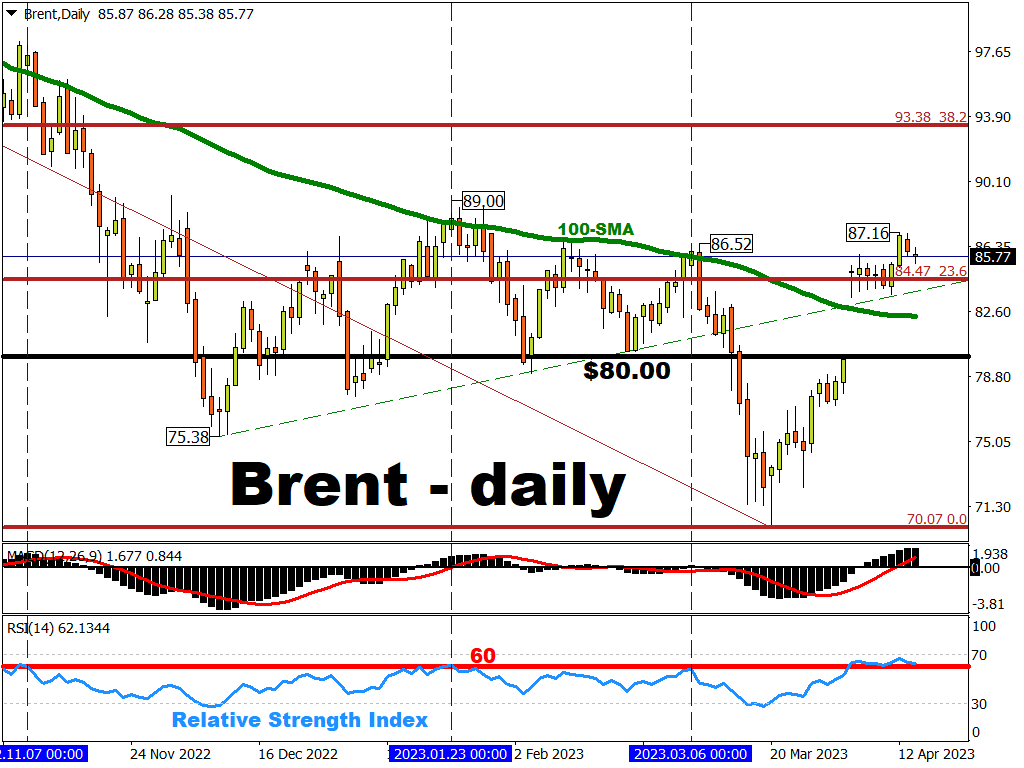

Will technical pullback pave way for $90 Brent?

Brent oil is pulling away from its mid-week peak, unable to hold recent gains despite Thursday’s weaker US dollar in light of that larger-than-expected drop in US producer prices.

OPEC’s bullish report yesterday that pointed to a widening deficit later this year also failed to preserve Brent at this week’s cycle high above $87.

Note however that Brent’s 14-day relative strength index is easing lower towards that 60 mark which had typically triggered Brent’s technical pullback in recent months.

It appears that Brent prices are busy clearing some froth after embarking on a 4-week winning streak - its longest weekly winning run since June 2022.

Ultimately, for Brent to fulfill forecasts of $100/bbl, markets must be continuously shown signs that global demand remains resilient, even with the lowered OPEC+ output for the rest of the year.

Should next week’s data dump out of China, as well as the PMI prints for various major economies, show better-than-expected results, that may pave the way for $90 Brent, once the froth has been cleared in the interim.

Latest reviews

There's a better website for you

A new exciting website with services that better suit your location has recently launched!

Sign up here to collect your 30% Welcome Bonus.