Markets braced for “Whipsaw Wednesday”

It has the potential to be a volatile middle of the week with key data, a central bank meeting and the minutes from the most recent FOMC meeting all set to hit markets within a few hours of each other.

The latest US inflation data is the marquee risk event on the calendar and is expected to support one more 25bp Fed rate hike at its May meeting. Odds of this happening have jumped up from a near coin toss before Friday’s jobs data to around 74%.

Headline CPI is forecast to hit 5.2% from 6.0% in February led by falling fuel costs, although this may be offset by high food inflation.

This would be the lowest reading since June 2021.

Shelter prices remain the wildcard and the key contributor to recent price pressures. Economists reckon another solid monthly core number - 0.4% is expected - will worry policymakers as that is more than double the rate required over time to push back inflation to the FOMC’s 2% target.

The Fed’s favourite CPI indicator - core services inflation less shelter - will also be in focus as this is wage driven and remains sticky.

Recent commentary from Fed officials suggests they feel they have more work to do to ensure persistent inflation is eliminated. This could be highlighted in the minutes from the Fed’s March meeting which are released a few hours after the inflation data.

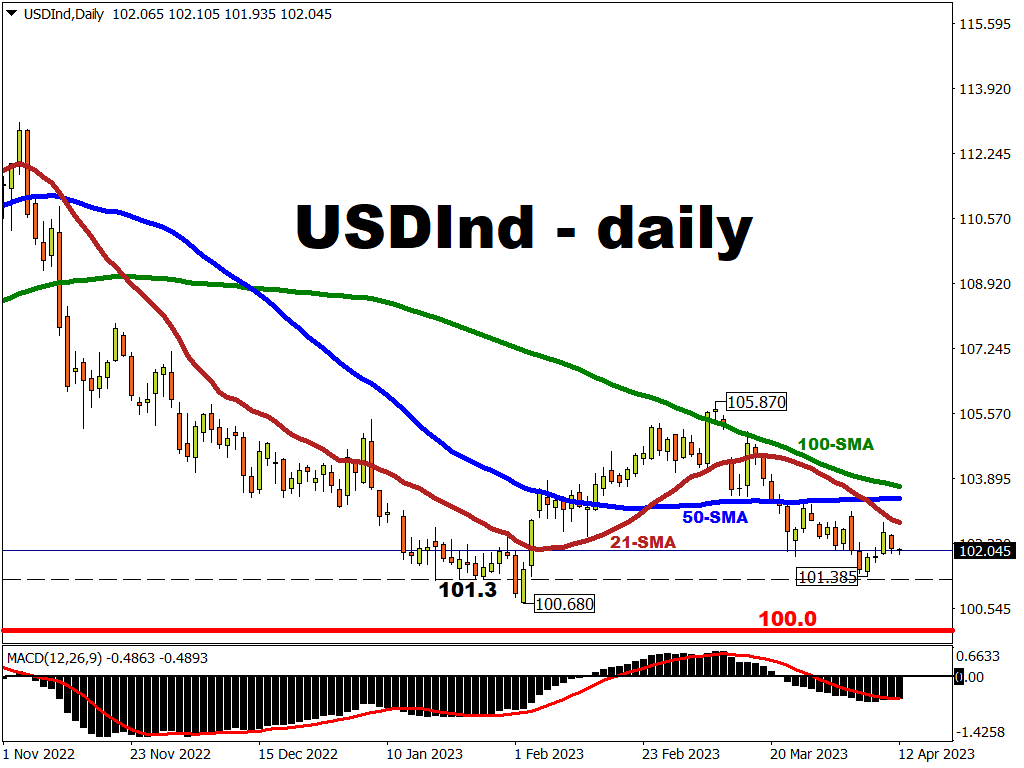

Stubborn core figures will deal a further blow to any imminent pause in policy tightening and should underpin some support for the dollar.

But a downside surprise in the data could add fuel to the disinflation story that Chair Powell has talked about recently and would push the greenback towards its year-to-date lows.

BoC set to stand pat

Money markets fully expect the Bank of Canada to hold rates at 4.5% in what should be a fairly easy decision.

The rebound in first quarter GDP and the tight labour market put some pressure on policymakers but the recent banking stress and falling inflation have removed any need to move rates at this meeting.

Balancing stronger growth and a more ominous outlook could result in a mixed tone by the bank with the “conditional pause” phrase used previously wheeled out again.

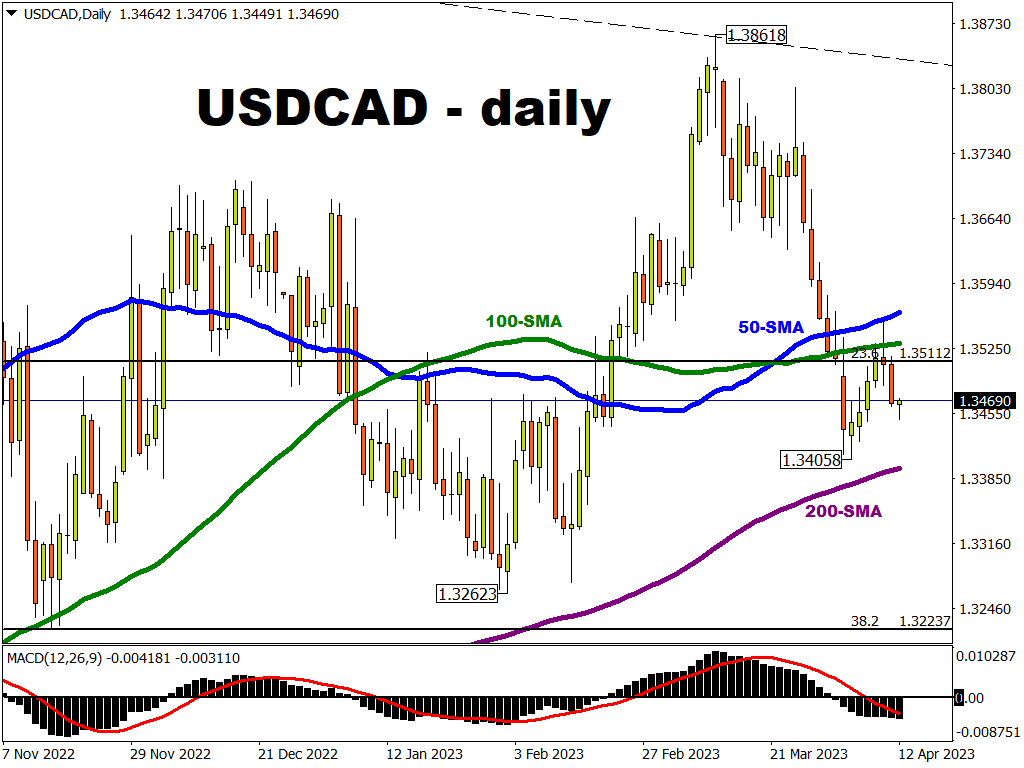

USD/CAD looks to be turning lower after printing a “doji” candle on Monday.

A soft close yesterday could see a drop to the April bottom at 1.3405. The 200-day simple moving average resides just below here at 1.3394.

CAD positioning by major funds and speculators remains one of the biggest bearish bets in over a decade so the major could be vulnerable to a squeeze.

Certainly, the better risk mood and firmer crude prices are also helping the loonie.

Latest reviews

There's a better website for you

A new exciting website with services that better suit your location has recently launched!

Sign up here to collect your 30% Welcome Bonus.