Dollar battles the medium-term downtrend

FX markets have been relatively quiet in recent sessions though the bout of selling in US stocks overnight sparked a bid for the dollar. Concerns over the banking sector have been raised again after First Republic revealed customers had pulled more than $100 billion of deposits last month amid the sector stress. All eyes are now on the Big Tech earnings released this week which saw Microsoft and Alphabet beat estimates after yesterday’s closing bell, while Meta and Amazon announce their results tonight and tomorrow night.

With a 25bp rate hike by the Fed next week baked in, it seems investors are not taking on big positions ahead of the FOMC meeting. Sentiment around the banking sector may play a part in any guidance by Fed Chair Powell. Fresh instability there would hasten more dovish Fed bets and see the greenback stay on the back foot. The DXY remains in a downtrend after peaking in March at 105.88. Yesterday’s bullish engulfing candle may slow the downward momentum but prices need to head back above 102 to trigger more short-term gains and ideally 103 to call off the sellers.

EUR/USD’s potential double top

The pick up in risk aversion has seen the world’s most traded currency pair perform a U-turn just as it looked as though it could print fresh cycle highs above this month’s top at 1.1075. ECB hawks are still vocal about a possible 50bp rate hike still being on the table at its meeting next week. There is currently a bit more than 25bps of tightening priced in by money markets. The major will have to break the neckline around 1.0910 to see more downside. Minor dips have been a buy recently but this could be tested by a stronger-than-expected US GDP figure on Thursday. We note eurozone GDP data is released on Friday.

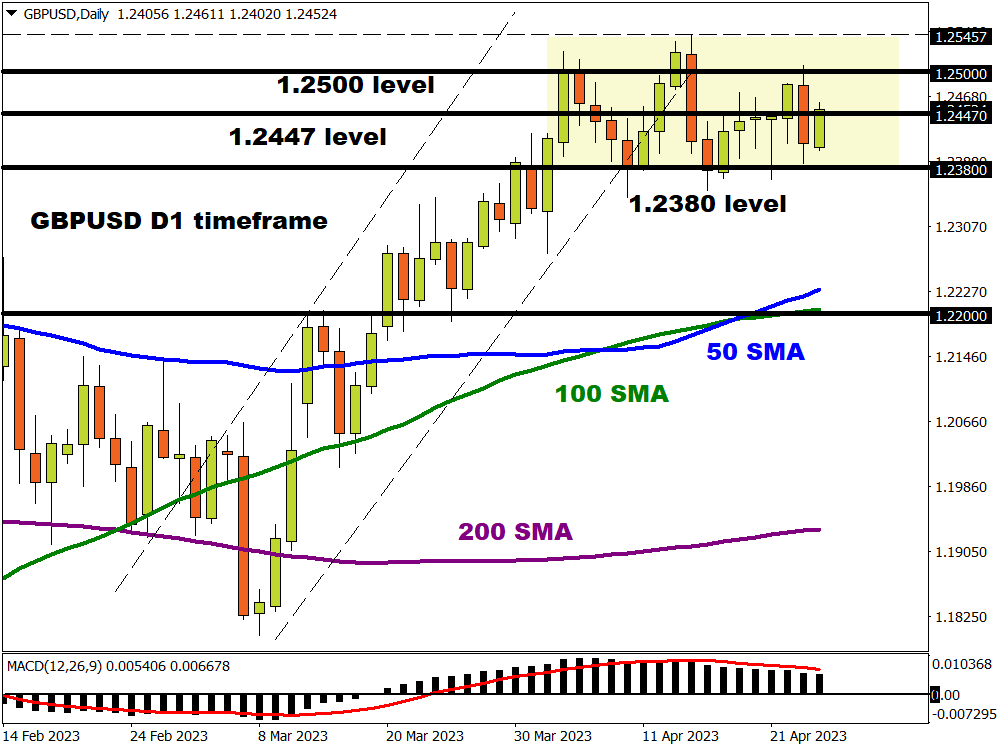

GBP/USD succumbs at 1.25 barrier again

It’s a very quiet week on the UK data front after recent strong inflation and wage growth figures saw a 25bp rate hike by the Bank of England get fully priced in by money markets. Indeed, traders reckon we get over 70bps more tightening this year which could be a stretch if the economy weakens, and headline inflation drops sharply in the coming months. Cable has a high correlation to the S&P 500 and global risk sentiment at present so the dip in stocks has pushed the major back below the January high at 1.2447. If we are forming the right shoulder of a “head and shoulders” pattern then a break down through 1.2380 could see a quick drop to 1.22.

Latest reviews

There's a better website for you

A new exciting website with services that better suit your location has recently launched!

Sign up here to collect your 30% Welcome Bonus.