This Week: Fed headlines major risk events for EURUSD

It’s the start of May and we are in for a very exciting week with no less than four major central bank meeting, as well as top tier data:

Monday, May 1

- May Day holiday: UK, France & China

- USD: ISM manufacturing

Tuesday, May 2

- AUD: RBA rate decision

- EUR: Eurozone consumer price index (CPI)

- USD: US factory orders, revised durable goods

Wednesday, May 3

- AUD: Australia retail sales

- EUR: Eurozone unemployment

- USD: Fed rate decision

Thursday, May 4

- CNH: China Caixin manufacturing PMI

- EUR: ECB rate decision

- USD: US initial jobless claims

- Apple earnings (after US markets close)

Friday, May 5

- CNH: China Caixin services PMI

- EUR: Eurozone retail sales

- USD: US April nonfarm payrolls (NFP)

The above calendar certainly shows a busy few days this week, and no doubt increased volatility too.

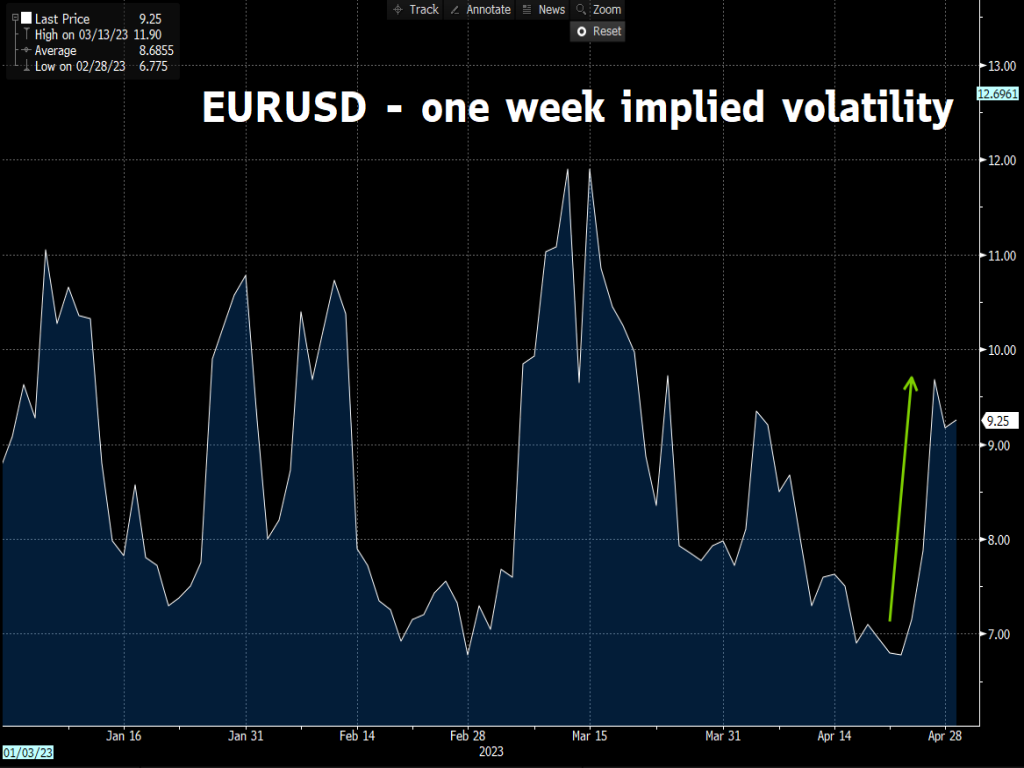

Take for instance the one-week implied volatility for the world’s most traded FX pair: EURUSD.

It surged to its highest levels in over a month, since the prior ECB and Fed policy meetings in March.

Here are the market’s expectations for this week’s key events:

- Tuesday, May 2nd: The EU’s headline inflation is forecasted to tick back up to 7% in April, higher than the 6.9% from March.

A higher-than-expected CPI print may spur the European Central Bank (ECB) into further rate hikes, which in turn may extend the Euro’s recovery.

- Wednesday, May 3rd: Markets forecast an 89% chance that the US Federal Reserve will hike by a further 25 basis points (bps) – the final hike in this cycle that began over a year ago.

Confirmation that the peak or at least a pause in rates is in, is what the markets want to hear as they have priced in cuts towards the end of the year.

New cycle lows for the dollar will come quickly if Fed Chair Jerome Powell sounds more cautious.

- Thursday, May 4th: After this week’s 25-bps hike by the European Central Bank (ECB), markets expect another 50-bps in hikes before 2023 is over.

However, if ECB President Christine Lagarde presses home policymakers’ hawkish intentions (want to keep hiking rates), that may embolden Euro bulls,

- Friday, May 5th: The US labour market is forecasted to have added 180,000 new jobs in April – its lowest tally since 2019 – while the unemployment rate is expected to tick higher to 3.6%.

A lower-than-expected headline NFP number/higher-than-expected unemployment rate may ease US inflationary pressures, which in turn should allow the Fed to indeed to hit pause on its rate hikes, as markets predict.

If the official outcome differs significantly from the above scenarios, that could trigger wild moves for EURUSD.

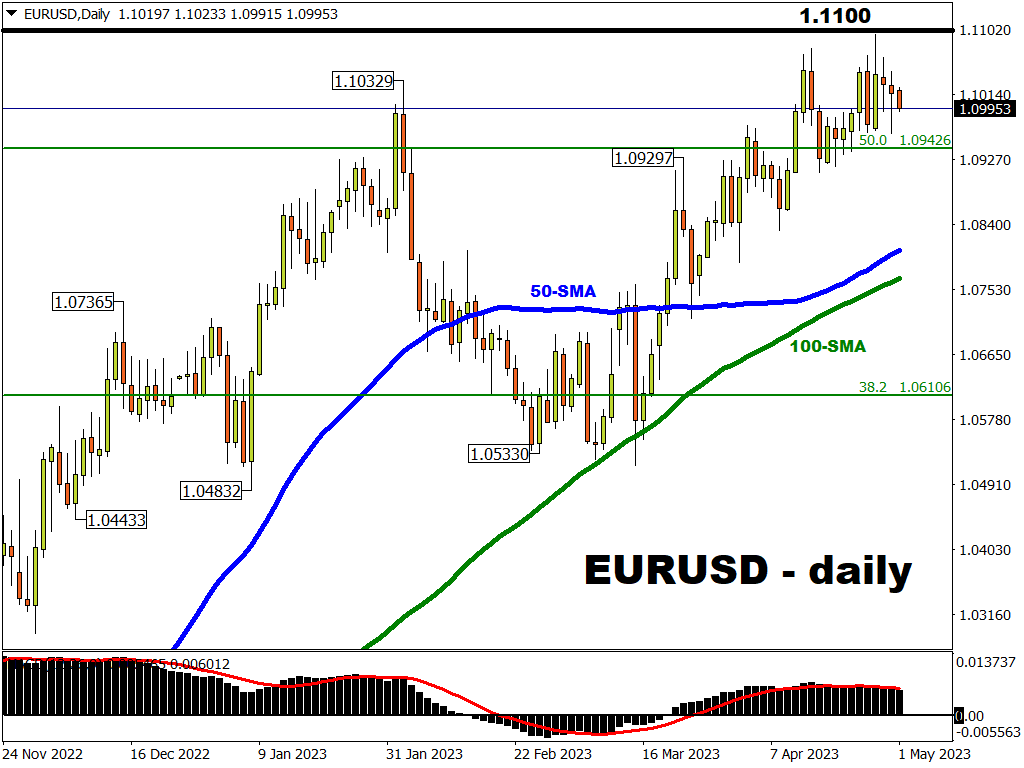

Looking at the price charts, the world’s most-traded FX pair is battling around the psychologically-important 1.100 mark at the time of writing.

Dip buying since late-September suggests that the path of least resistance is for fresh new highs.

- EURUSD bulls (those hoping prices will move higher) certainly have their thoughts set on posting a fresh one-year high, looking for a daily close above 1.110 for the first time since March 2022.

- However, if this week’s fundamental events pan out in favour of the US dollar, that may drag EURUSD back towards the 1.09426 level, where lies the 50% Fibonacci retracement level from the January 2021 to October 2022 drop for the world’s most-traded FX pair.

Also at the time of writing, Bloomberg’s FX model points to a 73% chance that EURUSD will trade within the 1.0863 – 1.1135 range over the next one-week period.

Latest reviews

There's a better website for you

A new exciting website with services that better suit your location has recently launched!

Sign up here to collect your 30% Welcome Bonus.