EURUSD awaits Fed-ECB decision combo

A strong bout of risk-off hit markets and investors yesterday as the banking crisis ramped up a notch.

A third financial institution failed over the weekend in the US which saw the regional banking index Stateside fall close to 6% yesterday, its worst session since mid-March.

Jitters around its banking system won’t go away with some investors asking which “domino” is next to fall.

Right on cue, the FOMC meeting and its policy decision is announced later today.

Consensus fully expects another 25bp rate hike, taking the target range to 5% to 5.25% which would be its highest level since the summer of 2008.

Markets have been second guessing the FOMC on its terminal rate for months now and we are getting very close to the end game.

But officials are having to balance the need to slow sticky inflation against a pressing set of risks including systemic banking fears and more failures together with the chance of a US debt default as soon as next month.

Concerns over a hard landing are also growing as tightening lending conditions will crimp economic activity going forward.

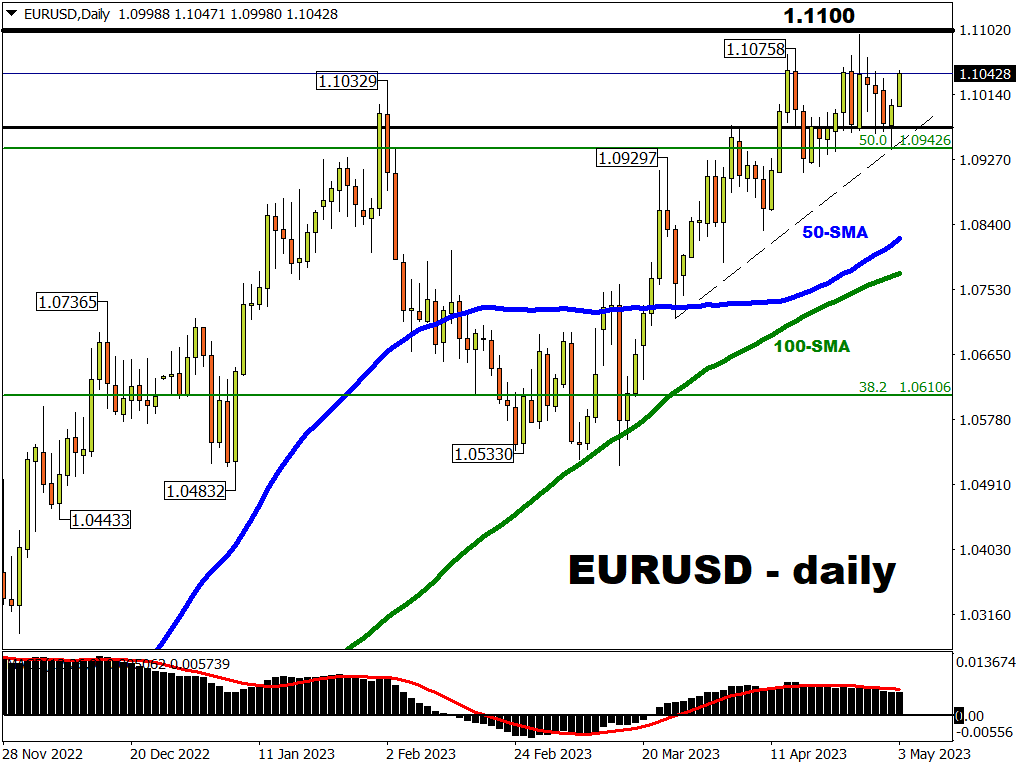

EUR/USD holds trendline support amid data and rate decisions

The world’s most popular currency pair drifted towards the low end of its recent trading range in the mid-1.09s yesterday.

April preliminary inflation data came out more or less in line with expectations, rising 0.7% m/m for a 7.0% gain in the year. This was one-tenth above forecasts of a 6.9% print. But core inflation eased to 5.6%, down a tenth from March.

The widely watched Bank Lending Survey published on Tuesday also indicated that Europe’s banks are making it harder for people to borrow while its companies are much less keen on taking out loans.

The data tilts risks towards a 25bp hike on Thursday from the ECB.

Markets continue to price in the chances of another 50bps of increases over the next couple of months.

Hawkish guidance by President Lagarde, perhaps relatively more hawkish than the Fed, may help bolster EURUSD later in the week.

EUR/USD dipped to 1.09422 on Tuesday before rebounding off the long-term 50% level of the 2021-22 decline.

Short-term trendline support from late March has also supported prices.

Euro bulls will be eyeing the mid-April cycle high at 1.10758, with the psychologically-important 1.110 handle also tantalisingly close.

Latest reviews

There's a better website for you

A new exciting website with services that better suit your location has recently launched!

Sign up here to collect your 30% Welcome Bonus.