Markets await crucial US inflation data

It’s CPI day, which means markets have been relatively subdued ahead of this marquee risk event.

Debt limit negotiations are ongoing with no substantive progress as yet. White House staff and legislators are set to meet daily with President Biden then to convene with congressional leaders on Friday. These negotiations normally generate a lot of noise and need to get much worse before they then get resolved … until the next time.

The dollar is trading rangebound with a non-committal tone ahead of this afternoon’s report.

CPI to inform the Fed’s next decision

Having peaked above 9% in the middle of last year, expectations are for headline CPI to print at 5% in April, unchanged from March.

The core rate, which excludes volatile food and energy costs, is also expected to ease slightly to 5.5% from March’s 5.5%. Services inflation is forecast to remain elevated and not decline meaningfully until later in the summer, while core goods prices are expected to stay flat.

Inline prints will be unpleasantly high for policymakers with CPI still running at more than double the Fed’s 2% target.

But the headline reading would be at the slowest pace in nearly two years and confirm gradual disinflation, with shelter costs helping this process in the next few months.

The Fed is expected to remain on hold during that time as uncertainty in the banking sector continues to tighten credit conditions and lending standards.

In fact, while the data will be seen as sticky, other price measures like business inflation expectations are now falling sharply. This environment could potentially push CPI much closer to target by December as unemployment rises.

Certainly, money markets believe this will happen, with close to three 25bp rate cuts by year-end priced in.

Will the data confirm this bias and see the dollar potentially test its year-to-date lows? On the flip side, a strong report will further cement another potential rate hike in June. Markets currently assign a 16% chance of a 25bps rate rise on June 14th.

We note the May CPI report is released the day before the June FOMC meeting.

Majors nears recent highs

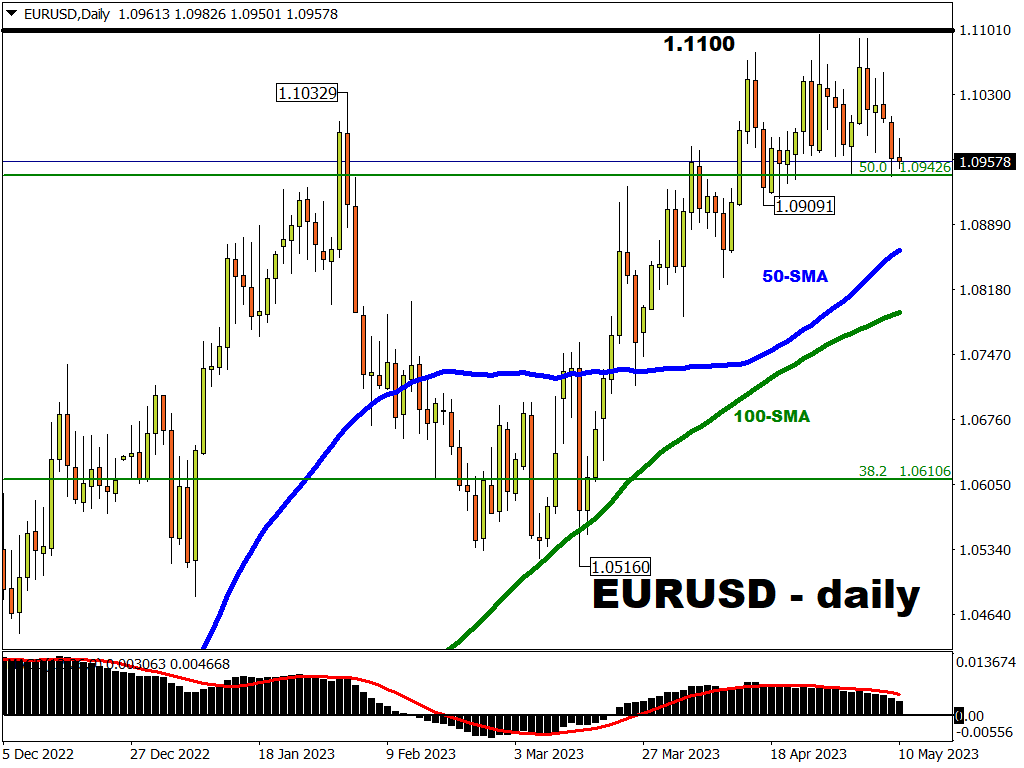

Regarding the FX majors, EUR/USD yesterday turned lower and through its short-term trendline support from the March low.

The midway point of the 2021-2022 decline sits at 1.09426 with the mid-April low at 1.09091. The big round number at 1.11 remains formidable resistance with recent highs around 1.1092/956.

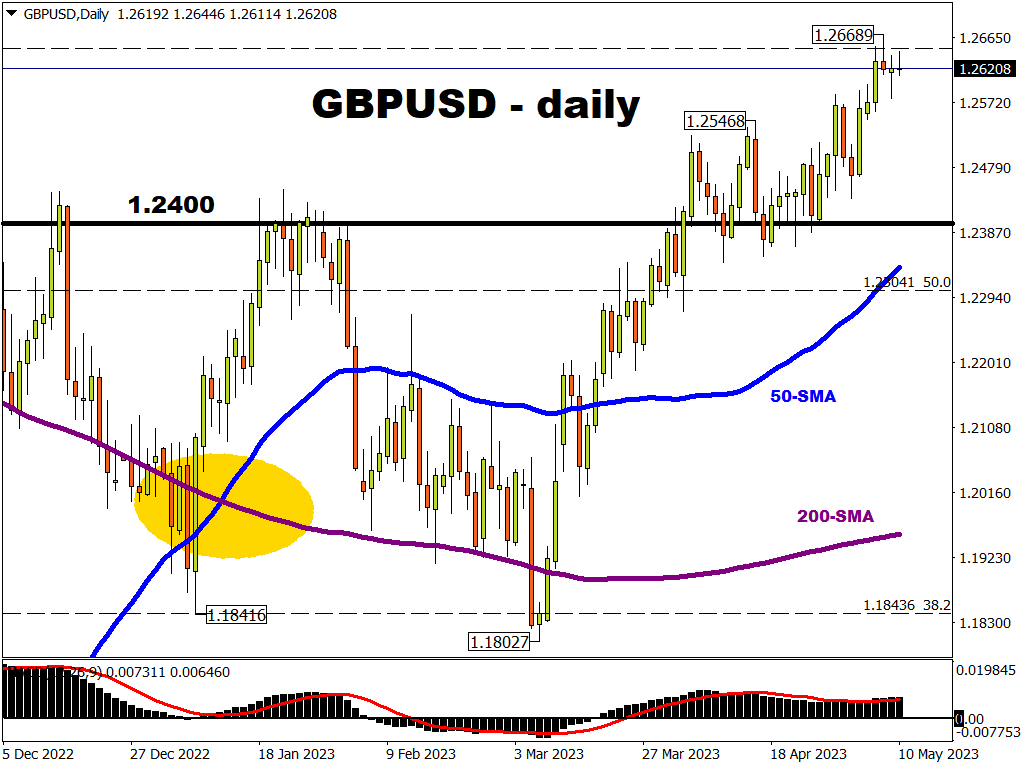

GBP/USD hit one-year highs at 1.26689 on Monday.

That is again the target for bulls with near-term support at 1.2578. traders also have one eye on tomorrow’s Bank of England meeting.

Latest reviews

There's a better website for you

A new exciting website with services that better suit your location has recently launched!

Sign up here to collect your 30% Welcome Bonus.