This Week: Big Tech earnings vie with packed data calendar

Bank stresses have calmed and the combination of solid activity data along with persistently high core inflation has seen markets nail on a 25bp rate hike at the Fed’s May meeting.

The upcoming week is full of important data, though it seems likely that this won’t change the dial for the imminent rate decision.

Monday, April 24

- EUR: Germany April IFO business climate

- Walt Disney may cut thousands of jobs this week

- Q1 earnings from embattled banks: Credit Suisse, First Republic Bank

Tuesday, April 25

- USD: US April consumer confidence

- NQ100_m: Microsoft, Alphabet Q1 earnings (after US markets close)

Wednesday, April 26

- NZD: New Zealand March external trade

- AUD: Australia March CPI

- CAD: Bank of Canada releases April meeting minutes

- NQ100_m: Meta Q1 earnings (after US markets close)

Thursday, April 27

- EUR: Eurozone April economic confidence

- USD: US 1Q GDP; weekly initial jobless claims

- NQ100_m: Amazon Q1 earnings (after US markets close)

Friday, April 28

- JPY: Bank of Japan rate decision; April Tokyo CPI; Japan March industrial production, retail sales, and unemployment

- EUR: Eurozone 1Q GDP; Germany April CPI

- USD: US March PCE Deflator, personal income and spending

First quarter US GDP will grab the headlines with growth expected to moderate from the 2.6% in the previous quarter. Persistent price pressures will be evident in Friday’s core PCE data which should highlight the ongoing concern of policymakers at the FOMC. It is the blackout period now ahead of its meeting next week so there won’t be any official “Fedspeak” to listen out for.

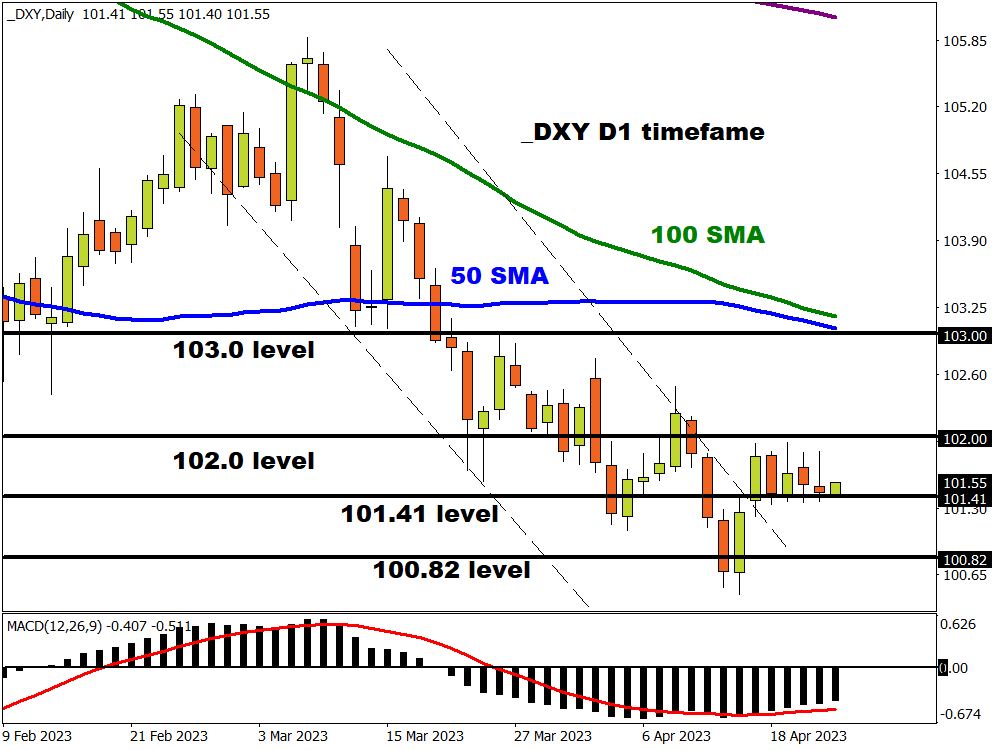

The dollar did stop the streak of six consecutive weekly losses, but it remains in a downtrend from the mid-March top. Markets are still continuing to price in aggressive rate cuts by the Fed into 2024 so unless these bets get reined in, the greenback may struggle to move much higher. One risk event looming is the debt ceiling issue which probably has to get much worse before getting resolved. That means tensions could linger into the summer and weigh on USD sentiment.

The recovery of the eurozone economy from last year’s energy price shock is expected to be confirmed on Thursday with the release of gross domestic product data showing a return to positive growth in the first quarter. The euro remains resilient against the USD with recent PMI figures suggesting growth may be picking up a bit momentum, in turn supporting more ECB rate hikes ahead.

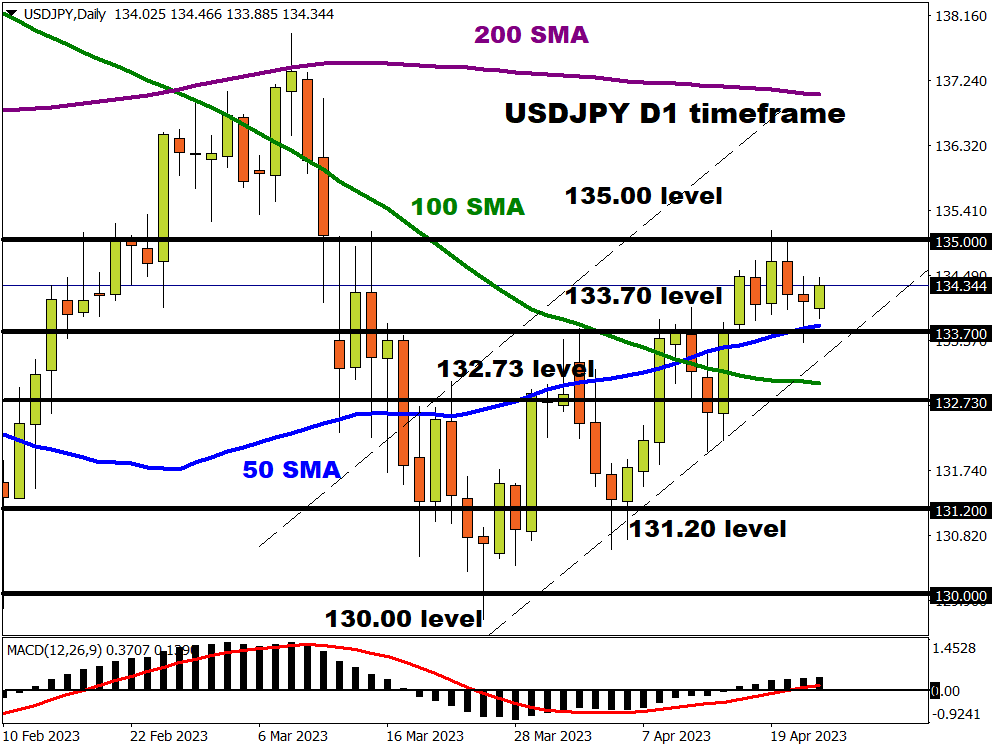

There is much speculation about Governor Ueda’s inaugural Bank of Japan meeting on Friday as multi-decade high inflation is making it tough for the BoJ to keep its ultra-loose monetary stance. It seems it is too early for any policy tweaks as officials have been saying it needs wage inflation to end yield curve control. But there could be some groundwork put in place to move policy towards the outlook for inflation. This could sow the seeds for tighter policy which would give a strong bid to the yen and see USD/JPY moving back towards 130 and below.

Finally, a slew of megacap tech earnings is released over the coming days with Alphabet, Microsoft, Meta, and Amazon all announcing their latest results. These companies account for close to 14% of the S&P 500’s weight so will be important for near-term direction. They have also driven the strong index gains seen this year as one of the most crowded trades in 2023. Solid guidance or hints the sector will continue to remain resilient even when economic growth slows would help keep Wall Street’s decent start to the year afloat.

Latest reviews

There's a better website for you

A new exciting website with services that better suit your location has recently launched!

Sign up here to collect your 30% Welcome Bonus.