AI in Forex: the future of day trading, or a catastrophe waiting to happen?

The rise in artificial intelligence (AI) technology almost seems to have taken us by surprise, growing exponentially over the past 12 months to the point where almost no industry is fully AI-free. This is largely due to the emergence of ChatGPT in late-2022, kicking off an AI craze that captured the public’s attention in a way other forms of AI have previously been unable to.

With chatbots and algorithmic AI being integrated into various sectors – from healthcare to customer service – there is seemingly no limit to the potential of this new technology, and this poses questions for the status quo in Forex markets, as well.

The Forex markets can often be regarded as overwhelming for new traders, with so many factors to consider in order to effectively manage risk and turn over a profit. With the increasing potential of modern AI technology, can this be used to guide new traders in terms of identifying market trends and recognising what constitutes a risky deal?

Here at Alpari, we are interested to see just what the integration of these new AI applications could mean for the future of Forex markets, alongside determining how much traders should trust in artificial intelligence when making trades.

Opportunities for AI optimization in FX

AI technology has come a long way in a very short space of time, with chatbots – such as ChatGPT – rapidly becoming well-integrated into many facets of society. Forex is no exception to this, with AI already being rolled out across the market for a range of uses. As this technology learns and develops, the possibilities for its use in FX continue to grow.

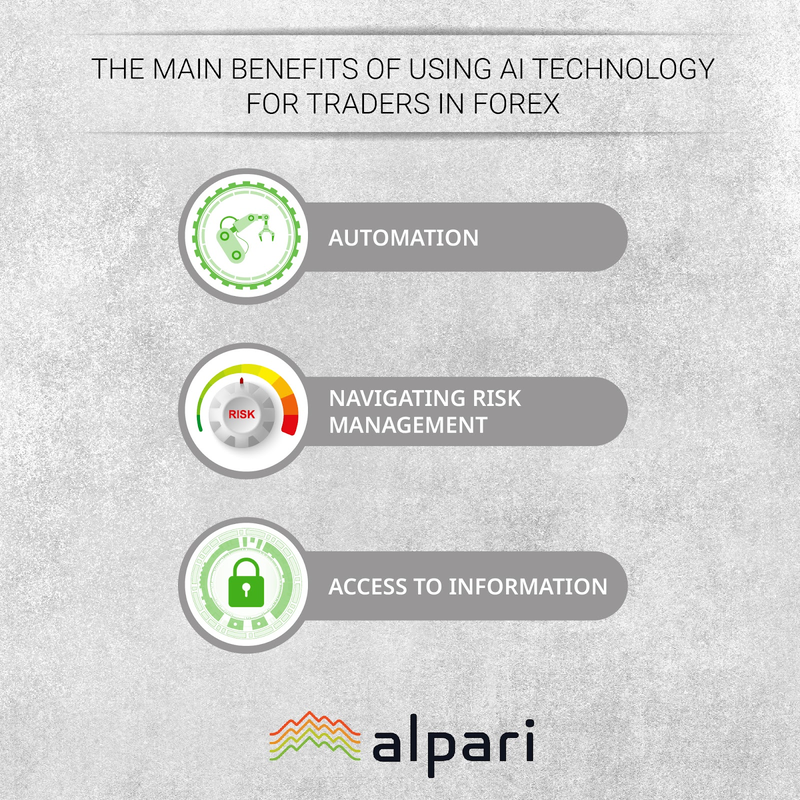

Currently, some of the main ways in which AI technology is being used to benefit traders in Forex include…

Automation

Forex is a time-dependent market that is extremely fast-paced. A matter of minutes could see exchange rates fluctuate rapidly, and what was a good deal an hour ago could very quickly turn sour.

Thankfully, algorithmic AI technology is able to process huge quantities of market data all at once, far more than any human would be able to manage. This has allowed traders to automate their trading strategies, with AI being used to identify and act on opportunities as soon as they appear in real-time.

Refinitiv’s “FX Workspace Survey” in 2022 found that 43% of professionals working in finance cited trade monitoring as one of the tasks that could be most improved by access to new AI tools, while 36% similarly cited trade execution.

Traders are able to teach the AI about their preferences and objectives, and the technology is constantly evolving and learning from past mistakes – meaning it actually becomes an even more effective tool over time.

By automating trading in this way, AI also offers the potential for traders to capitalize on market opportunities without even having to lift a finger.

Navigating risk management

The FX market can be a lucrative money-making opportunity for savvy traders. However, it can also cause significant amounts of financial loss if traders rush into decisions without properly considering the risks involved ahead of time.

Currency values can be highly volatile, and things can change very quickly. This is why it is crucial for traders to be able to assess the risk of each trade and base their decisions on facts and informed predictions. This is where AI can really play a big part in helping to identify risks.

AI is able to effectively make use of predictive analytics – utilizing data and algorithms to track market fluctuations and identify the best times to trade ahead of time. The 2022 “FX Workspace Survey” found that 41% of FX brokerages are already using AI tools to automate data analysis and management.

While predictive analytics is nothing new, and has been used by traders for many years, the difference in using AI is the speed at which this process can be performed. AI is able to process data extremely quickly, which means it has a much better chance of identifying ideal trade conditions with enough time to spare to test for error.

Education

One of the key benefits of utilizing AI in FX is the ability to learn from the AI in a way that is more efficient and streamlined than traditional market education. Tools, such as ChatGPT, present the opportunity to ask questions and receive easy-to-digest answers that can build a good foundation of knowledge around market terminology, types of analysis, and key historical events – even providing access to introductory guides to trading.

Of course, all of this is dependent on the trader’s willingness to learn. However, it’s safe to say that AI presents a much more user-friendly and bespoke method of Forex education.

Access to information

There can be a lot of information for Forex traders to have to keep tabs on, and knowing where to start can feel overwhelming. GPT-powered AI chatbots can make this process significantly easier, helping to break down information and provide necessary explanations almost instantaneously.

By providing simple prompts or asking questions, information can be rapidly processed and presented to the user in a matter of minutes.

To demonstrate the ways in which these chatbots can provide detailed information to traders, we asked ChatGPT how to determine when it’s a good time to make a trade.

The following response has been entirely generated by AI.

We asked: ‘How can I tell when it’s a good time to trade on Forex markets?’

ChatGPT said:

‘Determining the best time to trade Forex markets involves considering various factors, including market volatility, liquidity, economic news releases, and your personal trading strategy. Here are some key points to consider:

Volatility: Higher volatility can present more trading opportunities, but it also carries increased risk. Volatility is often highest during overlapping trading sessions, such as when multiple major financial centers are active simultaneously.

Trading Sessions: There are four major trading sessions in Forex: Sydney, Tokyo, London, and New York. Each session has its characteristics in terms of liquidity and volatility. The most active and liquid session is usually the overlap between the London and New York sessions.

Economic Calendar: Keep an eye on economic news releases, as they can significantly impact currency prices. Important indicators include interest rate decisions, GDP figures, employment reports, and inflation data. News releases can create volatility and trading opportunities, but they can also increase the risk of sudden price movements.

Technical Analysis: Many traders use technical analysis to identify patterns, trends, and potential entry and exit points in the market. By studying price charts, indicators, and candlestick patterns, you can develop strategies based on historical price behavior.

Risk Management: Before entering any trade, it's crucial to define your risk tolerance and establish appropriate risk management measures. This includes setting stop-loss orders to limit potential losses and adhering to your predetermined trading plan.

Remember, trading on Forex markets involves risks, and there is no guaranteed method for consistently predicting market movements. It's essential to educate yourself, continuously learn, and practice disciplined trading strategies. Consulting with experienced traders or financial professionals can also provide valuable insights and guidance.’

Potential risk factors associated with utilizing AI

Of course, as much as AI offers many promising uses for FX traders, there is always an element of caution associated with entrusting artificial intelligence with financial decisions. Right now, many of the popular AI applications are still in their infancy – which lends itself to possible risks when using these technologies to inform FX trading decisions.

Using old information for current trades

The biggest risk associated with basing FX trades on information gathered via AI is that these applications make their predictions using historical data.

While this can mean that the AI is able to effectively identify recurring trends over time, there is always the chance that the data these applications have been trained on does not reflect current market conditions – which could mean predictions are incorrect, or simply missing important economic or political context.

There is always the possibility of errors

AI isn’t perfect, and these applications still have a long way to go in order to be entirely free from error. The majority of these AI Forex tools have appeared within the last 12 months, meaning they are still very young and there is still a significant risk of error – whether this comes from interpreting data incorrectly, or simply generating a false prediction.

This can be somewhat controlled by ensuring that these applications are kept regularly updated and that those responsible for creating them are continuing to further their development by feeding them new data on a frequent basis. However, there is no way to entirely remove the possibility of AI errors.

For this reason, traders making use of AI forecasts and trade ideas should thoroughly revise these suggestions before making any financial decisions.

How AI has reshaped the market and implications for the future

Financial markets are no stranger to AI, having first introduced machine learning algorithms to monitor stock market data in the early 1970s. However, this current era of AI technology is based almost entirely on computing and cloud data storage – meaning it could present a very different landscape for traders.

Already, AI has very quickly established itself as one of the biggest new tools on the market for traders – providing opportunities to identify prime market conditions, keep track of currency value fluctuations, and stay informed about political and economic influences.

In the past year, we have seen an increase in the number of ‘FX trading bots’ – algorithmic software that is able to automate trades using predetermined logic, based on historical market data and current currency values.

Several FX-specific AI applications – often equipped with trading ‘bots’ – have been launched to a positive reception from most traders and analysts alike. A number of AI applications have gradually become more widely used by traders of all experience levels.

AI is also being trialed by market analysts as a way of more effectively predicting rises and falls in the market by utilizing large quantities of historical data to draw conclusions and recognize patterns.

While much of this technology is still relatively new, and AI in FX markets is certainly not free from error, there is a lot of potential for these new applications to become the go-to approach for Forex professionals and beginners alike.

Will AI be able to replace the day trading market? Well, that still remains to be seen.

As of right now, it seems as though many traders are optimistic about the future of AI in Forex, and what the automation of trading could mean. However, it still remains largely unrealistic to envision a world in which AI completely replaces human interaction on the markets.

Our team of market analysts had this to say:

“Make no mistake: Artificial intelligence truly has the potential to transform financial markets and the trading experience.

Yet, we remain cognisant that FX markets are based on a system of winners and losers; forex trading is a zero-sum arena. Hence, AI cannot and will not make everyone a winner in every single trade/investment.

And perhaps moving forward into the AI era, the greater rewards may not belong to the more astute trader, but to the individual who possesses the capital and know-how to adapt quickest to newfound AI technologies.

Nevertheless, a human ultimately has to prompt the AI, to the benefit of the human. And therein lies a truly subjective and personalized experience.

Maybe the greatest reward that global financial markets can offer is not mere monetary profits. Instead, life is about taking risks, to persevere through uncertainty, to be able to act on your own free will. And that’s what makes for a truly human experience.”

With further monitoring of market fluctuations and the ability to have AI follow through on trades based on specific market indicators, this could effectively replace the day trading market and establish a more democratic market that allows traders to maximize their time for better trading opportunities.

Final thoughts

The widespread integration of AI technology into almost every aspect of society has shown both promise and potential risks for FX trading, offering the possibility of an entirely automated, while simultaneously reminding us of the errors that can occur when working with relatively-new algorithmic AI.

Right now, the integration of these new tools is still in its early stages. However, the constant development and improvement of AI technology suggests that we will be seeing much more of AI in the FX markets in the near future.

Of course, as with any form of market prediction and advice, utilizing ‘trading bots’ comes with the need for traders to do their own research and analyze suggestions made before committing financially to them. Overall, however, there seems to be a lot of promise shown by these new ways to automate the trading process and follow market patterns.

There's a better website for you

A new exciting website with services that better suit your location has recently launched!

Sign up here to collect your 30% Welcome Bonus.