Gold bulls’ last chance?

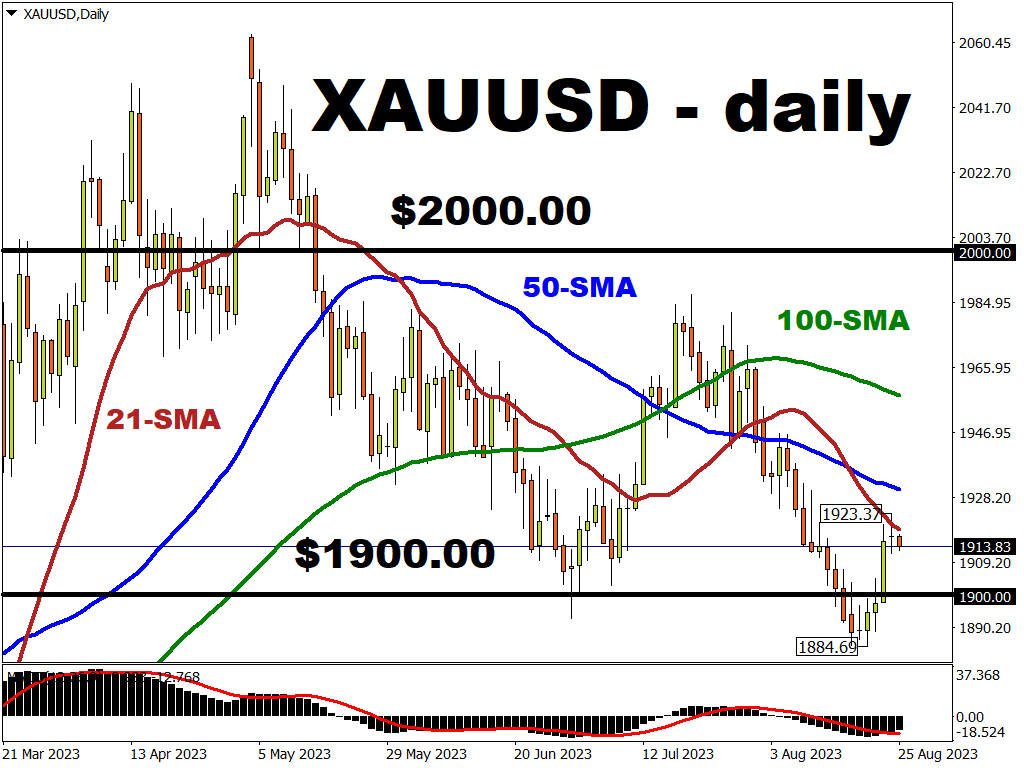

After falling below the psychologically important $1900 threshold, the price of gold has rebounded, reaching a 2-week high at $1923.37. The XAUUSD bulls have gained enough momentum despite the strengthening US dollar this week.

Fears of deteriorating conditions in major economies, such as the Eurozone, UK, and China, are buffering support for the safe haven gold.

However, from a technical perspective, the “doji" candlestick formed yesterday (Thursday, August 24th) points to indecision among gold bulls, who duly booked profits amidst the stronger US dollar on Friday, ahead of Fed Chair Powell’s highly-anticipated speech at Jackson Hole later today.

As markets now brace themselves for potential clues on the Fed’s next moves, XAUUSD bears are hoping that the recent (230k vs 240k forecasted) – lower-than-expected initial jobless claims data would provide enough ground for the Fed to continue on it’s hawkish trajectory and drag gold prices lower.

If Chair Powell manages to remind markets of it’s hawkish stance, XAUUSD bears might gain enough strength to reverse the recent recovery, with an eye on returning towards the psychologically-important $1900 level once more.

To the upside, the 21-period SMA is set to provide an immediate resistance, with the 50-period SMA standing right above the recent peak of $1923.37.

From a fundamental perspective, an extension of gold’s recent recovery would likely have to be based on a Fed that’s increasingly ready to halt its rate hikes.

Latest reviews

There's a better website for you

A new exciting website with services that better suit your location has recently launched!

Sign up here to collect your 30% Welcome Bonus.