Positive newsflow lifts Bitcoin

Bitcoin has found a bid over the last few sessions after dipping to a fresh multi-week low last Thursday at $24,750. There have been a few fundamental stories in favour of buyers in recent days with positive news that Blackrock, the money manger who looks after around $9 trillion of assets, was looking to push further into cryptocurrencies last week by filing an application with the US Securities and Exchange Commission (SEC) to offer a spot bitcoin exchange traded fund.

Blackrock already runs a bitcoin trust launched in 2022, but a new ETF fund overseen by the world’s largest money manger would be a huge vote of confidence for the crypto space and bitcoin especially, which has been suffering from really negative news including the collapse of FTX last year as well as the SEC’s decision to sue both Coinbase and the world’s largest crypto exchange, Binance, earlier this month.

The founder of the giant money manager, Larry Fink, has been openly critical of cryptocurrencies. but recently wrote in a letter to investors that there are interesting developments happening in the digital asset space. BlackRock currently offers over 1,300 different ETFs and the bitcoin proposal would extend the partnership with the troubled exchange Coinbase which would be the custodian of the fund’s bitcoin.

Bitcoin’s market dominance

This news and the SEC’s crackdown on cryptos has seen investors increasingly favour bitcoin which now makes up around 50% of the total crypto market cap. According to data from Coingecko, BTC’s current market cap stands at $519 billion. It is the first time in two years that bitcoin has breached the 50% mark, and this market dominance has surged by more than 10.5% since late November as investors look to the flagship crypto as a safe haven after recent turbulent times. Interestingly, Ether’s market share has been holding steady at around 20% over the past year and notably hasn’t increased.

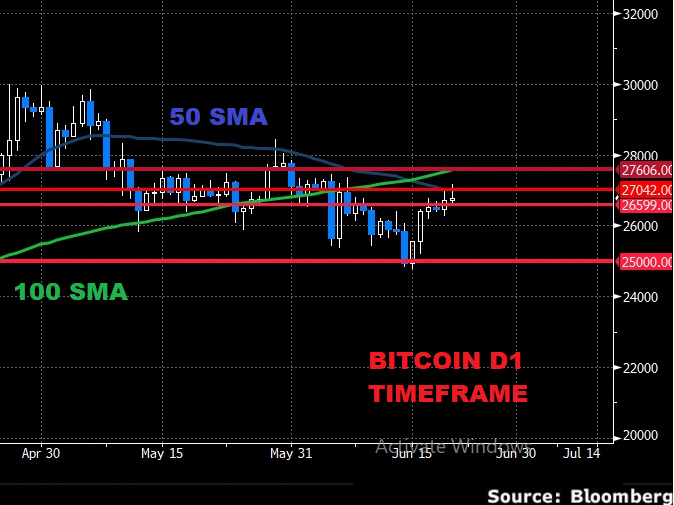

Looking at the charts, the 200-week simple moving average sits just below current pricing at $26,599. The 50-day moving average may act as initial resistance at $27,042. This has just crossed the 100-day moving average which resides above at $27,606. The February highs and last week’s low around $25,000 look likely to offer strong support.

Latest reviews

There's a better website for you

A new exciting website with services that better suit your location has recently launched!

Sign up here to collect your 30% Welcome Bonus.