Bitcoin bulls hope for immediate and longer-term boosters

The world’s largest crypto has had little trouble so far holding above the psychologically-important $30k line for the past 3 weeks.

Over the immediate term, with Bitcoin’s 50-day simple moving average set to cross above its 100-day counterpart, such a technical event may be seen as a bullish signal.

Treading water around its year-to-date highs, such relative price stability is remarkable despite the recent pushback by the SEC.

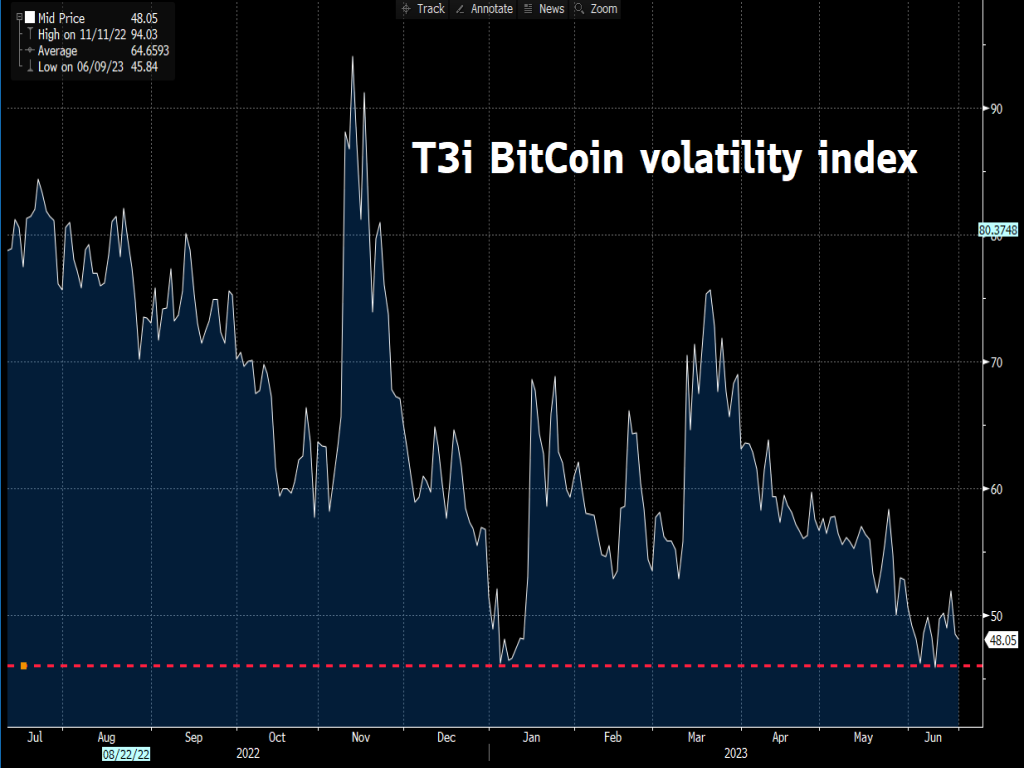

However, such resilience has also seen volatility plummet, perhaps to the chagrin of crypto traders.

According to the T3i BitCoin volatility index, the forecasted 30-day volatility of BTC is now hovering near this index’s record low.

Still, such a period of relative calm may be seen as a prime opportunity to accumulate the world’s largest crypto asset, at least in the eyes of its proponents.

To recap, the latest leg up back in June came in the immediate wake of BlackRock’s Bitcoin ETF application to the US Securities and Exchange Commission (SEC).

This ETF, if approved, promises greater access to the world’s largest crypto as retail investors can buy Bitcoin on a stock exchange, rather than having to seek out a crypto exchange.

For long-term HODLers …

Bitcoin investors may need to hold on perhaps until Q1 2024, when we might eventually know the fate of BlackRock’s application.

Looking further out, believers of Bitcoin are also awaiting the much-anticipated “Halvening” or “the Halving”, slated for April 2024.

This once-in-4-years event involves shaking up Bitcion’s underlying code, which reduces by 50% the amount of Bitcoin rewarded to miners.

In fewer words, the “Halving” makes Bitcoin scarcer.

And as Economics 101 theory postulates, scarcer supply should push prices higher, all else equal (including demand levels).

Hence, anticipation for both the “Halvening” as well as BlackRock’s Bitcoin ETF have already fuelled some bullish projections for spot Bitcoin prices:

- Standard Chartered has an end-2023 target of $50,000; and an end-2024 target of $120,000.

This latest projection than its prior forecast made in April for $100k Bitcoin by the end of next year.

- Cathie Wood, CEO and CIO of Ark Investment Management, predicts that Bitcoin will hit $1 million by 2030!

It sure is a long way to $120k, and even distant still to $1 million.

In the interim, crypto fans must continue holding the faith despite the threat of more Fed rate hikes and recession risks that are still playing out across the macro stage.

Latest reviews

There's a better website for you

A new exciting website with services that better suit your location has recently launched!

Sign up here to collect your 30% Welcome Bonus.