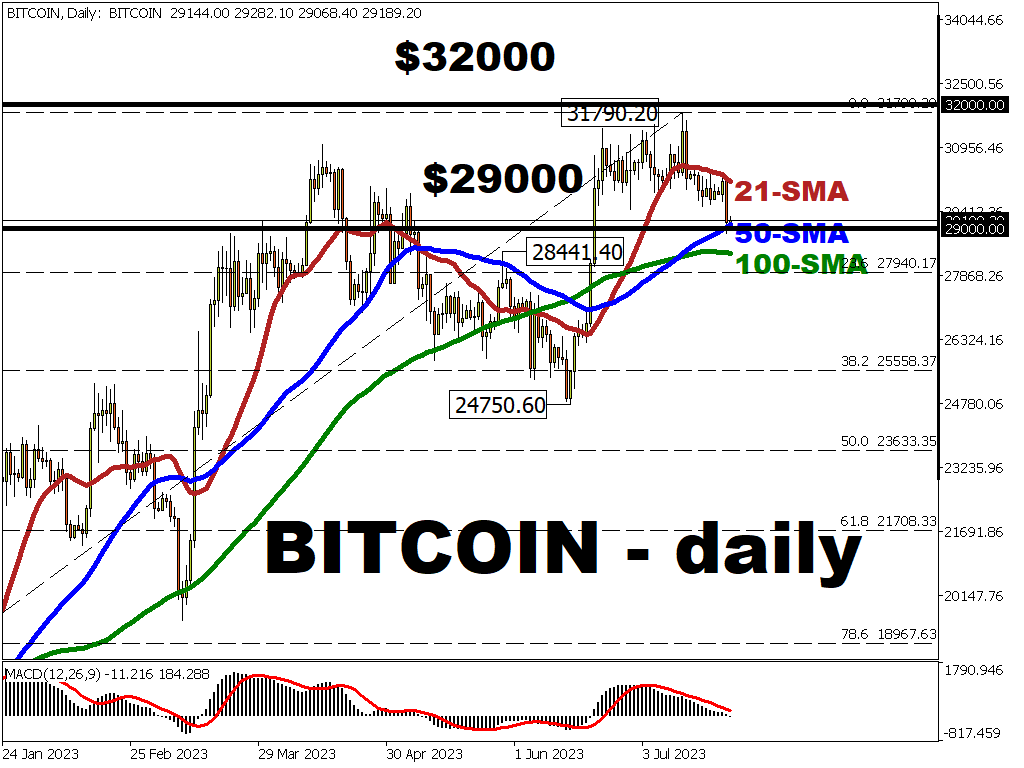

Bitcoin tests 50-day SMA support

Bitcoin has faltered away from the psychologically-important $30k, with the 50-day simple moving average (SMA) now being relied on to shore up crypto bulls’ defences.

The recent leg down for prices of the world’s largest crypto by market cap has now whittled its advance so far in 2023 to “just” 76.5% at the time of writing, compared to the 92% year-to-date gain it held as of July 13th.

There appears to be an ebbing of the euphoria from crypto’s recent twin boosters:

- BlackRock filed a Bitcoin ETF application to the SEC which promises to offer greater access to the world’s largest crypto for retail investors

- XRP’s newfound, though not yet fully confirmed, status that it’s not a “security” when sold to the public on an exchange. However, the SEC appears to be appealing that ruling by a federal judge in New York.

To be clear, there are still pockets within the crypto world where prices are pushing higher:

- Dogecoin is on course for back-to-back daily gains, now trading at a 2-month high, on hopes that this memecoin could play a major role on Elon Musk’s X platform (having shed its Twitter logo).

- Worldcoin doubled in price when it began trading yesterday (Monday, July 24th). Worldcoin is the token of the crypto project involving Sam Altman, the CEO of OpenAI of ChatGPT fame.

It appears that crypto has the propensity to react to sector-specific catalysts rather than macro drivers.

After all, Bitcoin’s correlation with the Nasdaq 100 index is near-flat on a 3-day rolling basis over the past one-year period.

While the crypto world may not have moved in lockstep with global financial markets of late, it still bears noting that seismic events may happen this week on the global stage.

Watch the Fed

The Federal Reserve, the US central bank that has the power to sway trillions across asset classes, is due to send out a crucial policy signal tomorrow (Wednesday, July 26th).

Cryptos could take heart if the Fed signal’s that this week’s 25-basis point (bp) hike to its benchmark interest rates will be the final such move in a series that stretches back to March 2022.

This could be the catalyst for a return to $30k Bitcoin and a retesting of its 21-day SMA as critical resistance.

However, if the Fed points to its benchmark rates moving higher even after this week’s 25-bps hike, that could send a risk-off wave across financial markets, perhaps heaping more downward pressure on cryptos.

This latter scenario may see Bitcoin bears test the 100-day simple moving average, as well as the late-May cycle high around the low-$28k region for immediate support.

A violent breakout to the downside may see Bitcoin finding truer support around the psychologically-important $25k mark, which had repelled bears prior to the mid-June ascent triggered by BlackRock’s ETF application.

Latest reviews

There's a better website for you

A new exciting website with services that better suit your location has recently launched!

Sign up here to collect your 30% Welcome Bonus.