Bitcoin muted through summer

The world’s most popular cryptocurrency continues to track sideways as it awaits the next catalyst.

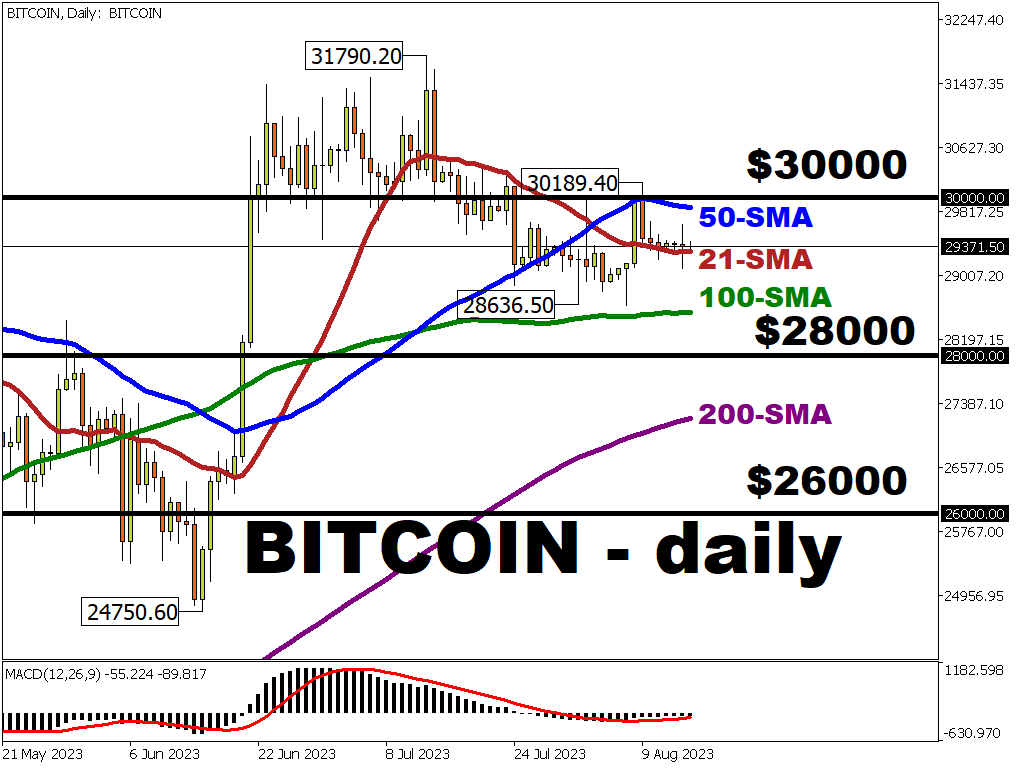

Prices have remained relatively stagnant recently after trading above the key critical resistance zone around $30,000 for most of July.

Last month saw a flurry of positive news around the announcement that BlackRock, the world’s biggest fund manger with assets under management totalling around a staggering $9 trillion, had filed to launch a spot bitcoin ETF.

This set off a burst of new applications or reapplications by the likes of Fidelity, Invesco, and Valkyrie, while Ark Invest had already filed to launch a spot bitcoin ETF in April.

Prices surged from below $26,000 in mid-June though the 50-day simple moving average and the psychological $30k level. Bitcoin is now consolidating near a pivotal support area which includes both the 21-day simple moving average at $29,311 and the lower boundary of a multi-month ascending channel.

There has also been lower volatility over the past few weeks with subdued price fluctuations, no doubt due to the summer months.

August is known for being a quieter few weeks in terms of liquidity and volumes. Indeed, any volatility this month can sometimes be taken with a large dose of scepticism until markets transition back toward what often turn out to be more difficult conditions through which to navigate.

Certainly, regarding the wider macro picture, attention should return towards September when major central bank meetings come thick and fast and hopefully bring us some much-needed clarity.

Inflation will remain the key focus with the current dovish narrative perhaps getting ahead of itself with key global commodity markets broadly rising and wage pressures and tight labour markets still evident.

Risk sentiment has turned sharply but briefly recently with both risk-on and risk-off phases in the wider market. But Treasury yields have surged as US data remains relatively solid meaning interest rates could stay higher for an extended period.

The longer bitcoin trades in a tight range, the bigger the ensuing range expansion should likely occur.

Through $30,000, the July top at $31,790 is a major target for bulls. Near-term support rests at the early low at the start of this month at $28,637, close to the 100-day simple moving average. The long-term 200-day simple moving average sits below here at $27,172.

Latest reviews

There's a better website for you

A new exciting website with services that better suit your location has recently launched!

Sign up here to collect your 30% Welcome Bonus.