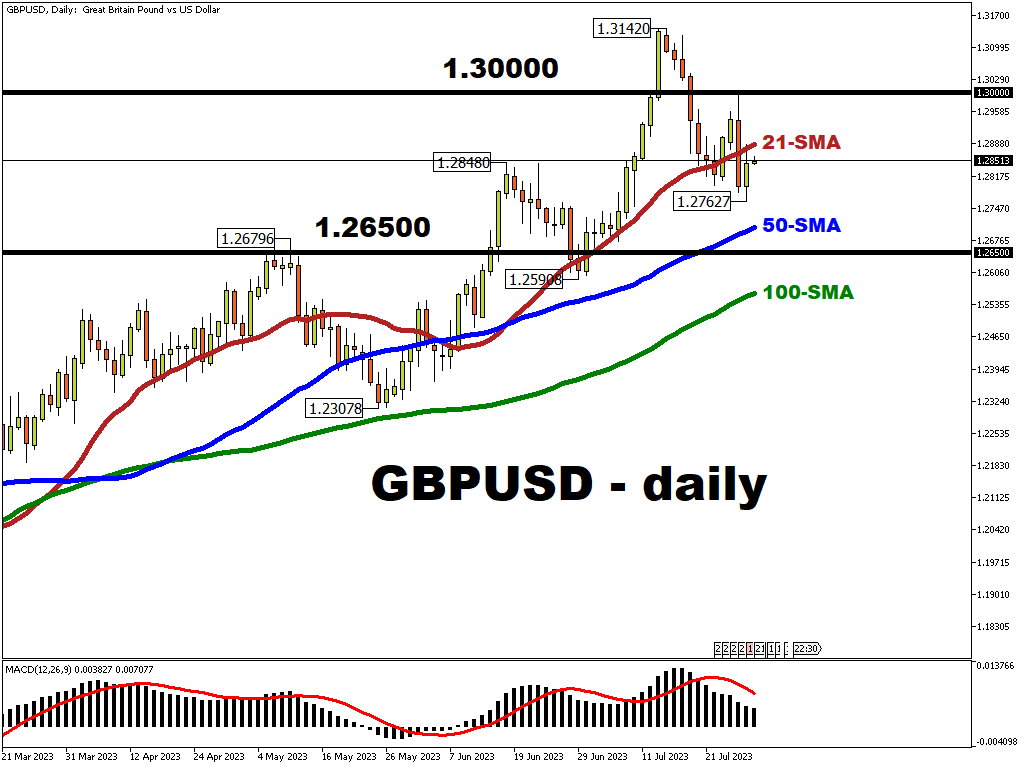

This Week: Will GBPUSD stay above or below 1.30?

It’s set to be the most-volatile week for GBPUSD traders since June, judging by the one-week implied volatilities for “cable”.

The Bank of England is due to make its rate decision, while “data dependent” traders (as well as Fed policymakers) will be close scrutinising Friday’s US nonfarm payrolls report.

The Bloomberg FX model currently predicts a 72% chance of GBPUSD trading within the 1.2650 – 1.3021 range between now and Friday.

This week’s major catalysts would go a long way in determining whether “cable” should stay above or below the psychologically-important 1.300 mark.

Events Watchlist:

- Thursday, August 3rd: Bank of England (BOE) rate decision

The UK central bank is widely expected to hike its benchmark rate by a further 25 basis points, in lockstep with the Fed and the ECB, bringing the BOE’s bank rate to 5.25% - its highest level since 2008. However, if the BOE delivers a shocking 50-bps hike, or suggests that more rate hikes are in store, that could send GBPUSD higher.

- Friday, August 4th: US July nonfarm payrolls (NFP)

Economists are forecasting a total of 190,000 new jobs added to the US labour market in July, which would be its lowest jobs growth tally since end-2019. Markets also expect the unemployment rate to remain at 3.6%, with wage growth moderating. However, a stronger-than-expected US jobs report should drag GBPUSD lower on bets that the US economy’s resilience would pave the way for a Fed rate hike in September.

Here’s a comprehensive list of other key economic data and events due this week:

Monday, July 31

- JPY: Japan June retail sales, industrial production

- AUD: Australia July inflation

- CNH: China July PMIs

- EUR: Eurozone July CPI; 2Q GDP

Tuesday, August 1

- JPY: Japan June jobless rate

- CNH: China July Caixin manufacturing PMI

- AUD: RBA rate decision

- EUR: Eurozone June unemployment

- USD: US July ISM manufacturing

Wednesday, August 2

- NZD: New Zealand 2Q unemployment rate

Thursday, August 3

- AUD: Australia June external trade; 2Q retail sales

- CNH: China July Caixin services PMI

- EUR: Eurozone June PPI

- GBP: BOE rate decision

- SPX500_m: Earnings from Apple and Amazon

Friday, August 4

- Brent: OPEC+ meeting

- EUR: Eurozone June retail sales

- USD: US July nonfarm payrolls

- CAD: Canada July unemployment

Latest reviews

There's a better website for you

A new exciting website with services that better suit your location has recently launched!

Sign up here to collect your 30% Welcome Bonus.