BoE and NFP to spark GBPUSD volatility

The Bank of England is due to make an interest rate decision tomorrow (Thursday, August 3rd).

At the time of writing, a 25-basis point hike is widely expected, with overnight swaps pointing to a 30% chance of a surprise 50-bps hike.

The UK and policymakers breathed a collective sigh of relief on the release of its recent cooler inflation data.

But while still-high services inflation slid, wage growth remains worryingly high.

This might force the MPC to hike again, but probably by only a quarter point on Thursday.

BoE Governor will be armed with a new Monetary Policy Report, but is expected to keep his options open, while possibly adopting a more data dependent stance. The UK economy is certainly slowing, as evidenced by recent PMI data.

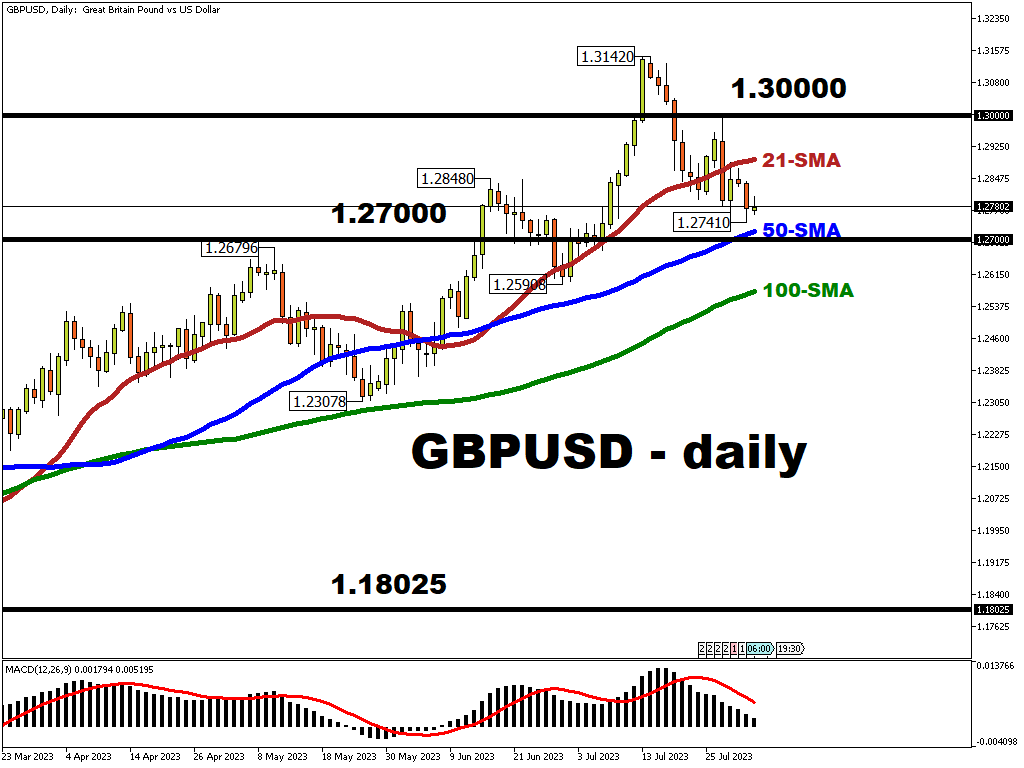

Sterling is holding onto long-term trendline support from the March lows.

The recent softer inflation numbers knocked GBP after the pricing of the peak BoE rate fell below 6%.

However, a larger-than-expected rate hike tomorrow by the BOE could see Pound bulls charging in once more to send GBPUSD higher.

While a half-point rate hike might really boost the pound, that might be short-lived if the MPC and Governor Bailey downplay the need for much more policy tightening.

A data dependent mantra could also see GBP struggle to reassert itself as the best performing major currency this year.

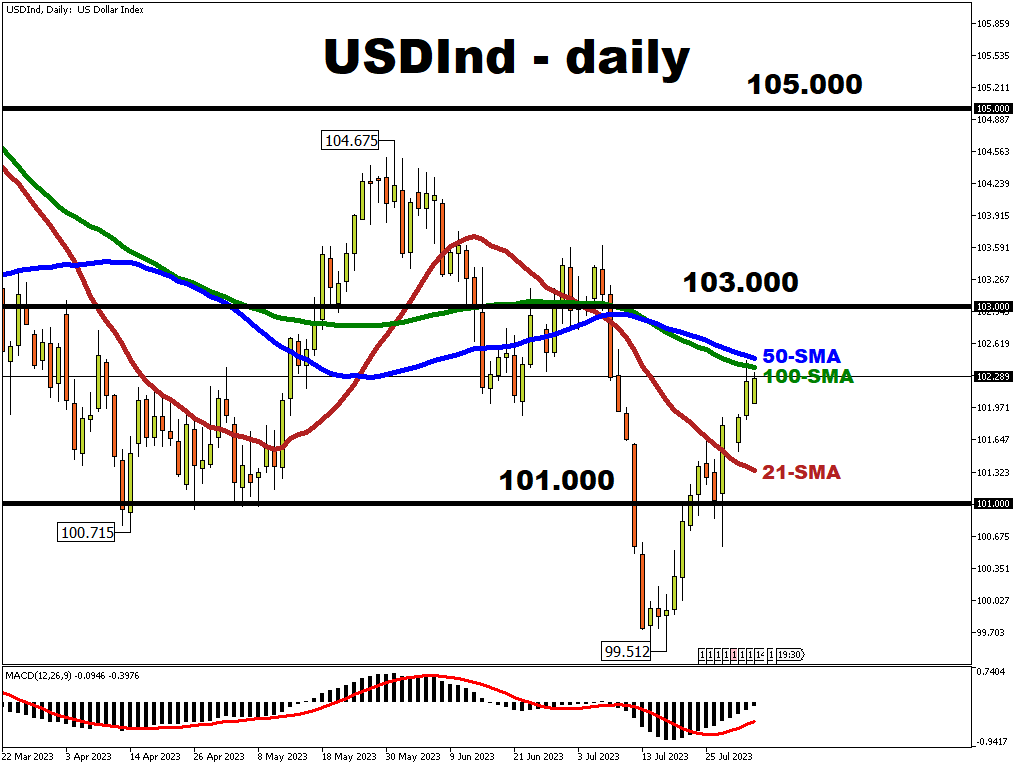

The dollar continued in corrective mode to kick off August and is largely ignoring the Fitch debt downgrade.

The greenback is trying to push up to levels last seen at the start of July before the latest soft US inflation data, only to be resisted so far at its 50-day and 100-day simple moving averages (SMA).

Lower price pressures plus decelerating job growth – the next nut to crack – could allow the Fed to pause for a prolonged period.

But lingering doubts are evident that the Fed might be done with raising rates.

US job openings yesterday fell to the lowest level in more than two years, leading us into the first Friday of the month and the marquee non-farm payrolls (NFP) report.

The Fed is now squarely in data dependent mode to determine its next policy action.

Friday’s NFP figures will have a major say in market direction.

Expectations are for a slight slowdown in the headline number to just below 200k.

We note that the June print was the first time in fourteen months that the consensus had overestimated the headline.

Another weaker-than-expected US jobs report this Friday could undermine the US dollar’s ongoing recovery.

Wage growth is set to tick one-tenth lower to 0.3% (MoM) while the jobless rate is seen steady at 3.6%.

Any fall in unemployment after a run of stronger growth data last week could give a nudge to the probability of a September hike and underpin support for the USD, which enjoys bullish seasonality in August.

That said, we do get one more monthly labour market report before the September FOMC meeting.

Hence, the US dollar’s fate before the next FOMC decision remains up in the air, and “data dependent”.

Latest reviews

There's a better website for you

A new exciting website with services that better suit your location has recently launched!

Sign up here to collect your 30% Welcome Bonus.