Dollar volatile ahead of Jackson Hole

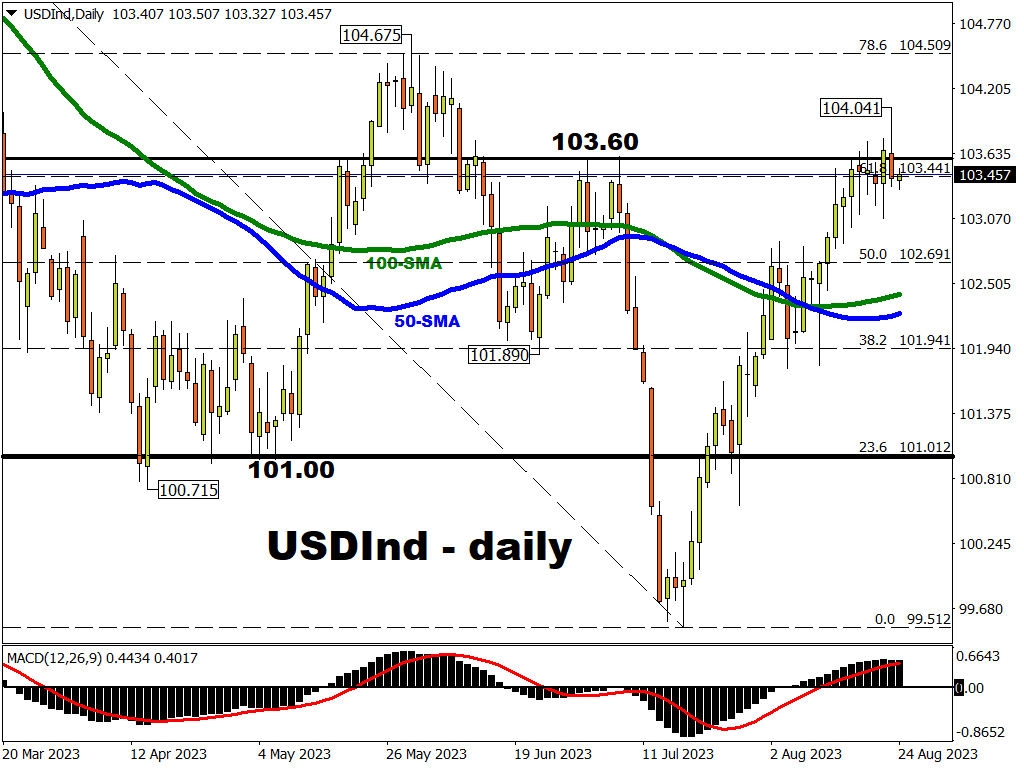

The greenback had a choppy session with the USD index breaking to the upside to post a fresh 2-month high on clear weakness in European FX after the release of soft PMI data.

Focus had been on the services sector and whether it would fall below the crucial boom/bust 50 level which marks expansion and contraction. It duly did, crimping interest rate hike expectations for the ECB September meeting.

Weak survey data out of the UK also hit sterling with the peak rate for the Bank of England falling.

Note that the euro and the British Pound account for nearly 70% of the DXY benchmark index, which is tracked by USDInd.

But gains for this USDInd were given back in the dollar after US non-farm payrolls benchmark revisions softened the prior job numbers while US PMIs also disappointed.

Focus now turns to Jackson Hole

Former policymakers and economists expect Fed Chair Powell’s keynote speech to emphasise a “higher for longer” rate stance.

After all, growth forecasts are being revised upwards and the US economy is proving much more resilient than previously expected.

There is also speculation that Powell could deliver some major long term policy hints that rising fiscal dominance, with huge Treasury issuance and the pressure this will bring to inflation risks, may require a lift to its long-term policy projections.

This would spark significant volatility.

EUR/USD’s third correction

Worse-than-expected PMI data shifted the dial for a September rate hike and saw the euro break down towards 1.08 yesterday.

The disappointing survey numbers pointed to a sluggish economy with recession as a strong downside risk.

Odds of a rate hike in a few weeks time have dropped to around 40% from close to 60% before the data.

We wrote a few weeks ago about the pair undergoing three corrections this year which has largely been due to heavy one-way positioning.

The previous ones saw falls of around 4% each.

The current drop from the high at 1.1275 in July is currently running over 3.5%. We note consensus end-of-year forecasts are still up around 1.12.

In the near-term, Tuesday’s gains stalled again around the 100-day simple moving average (SMA) at 1.0928 which should now act as resistance, with the 21-day SMA also joining in to potentially exert stronger resistance.

Prices had dipped enough to test the 200-day SMA for immediate support.

Any prolonged reversal needs to get above the 1.09426 long-term Fibonacci line to slow the downtrend.

Latest reviews

There's a better website for you

A new exciting website with services that better suit your location has recently launched!

Sign up here to collect your 30% Welcome Bonus.