GBPCHF: 3 potential targets identified

Summary

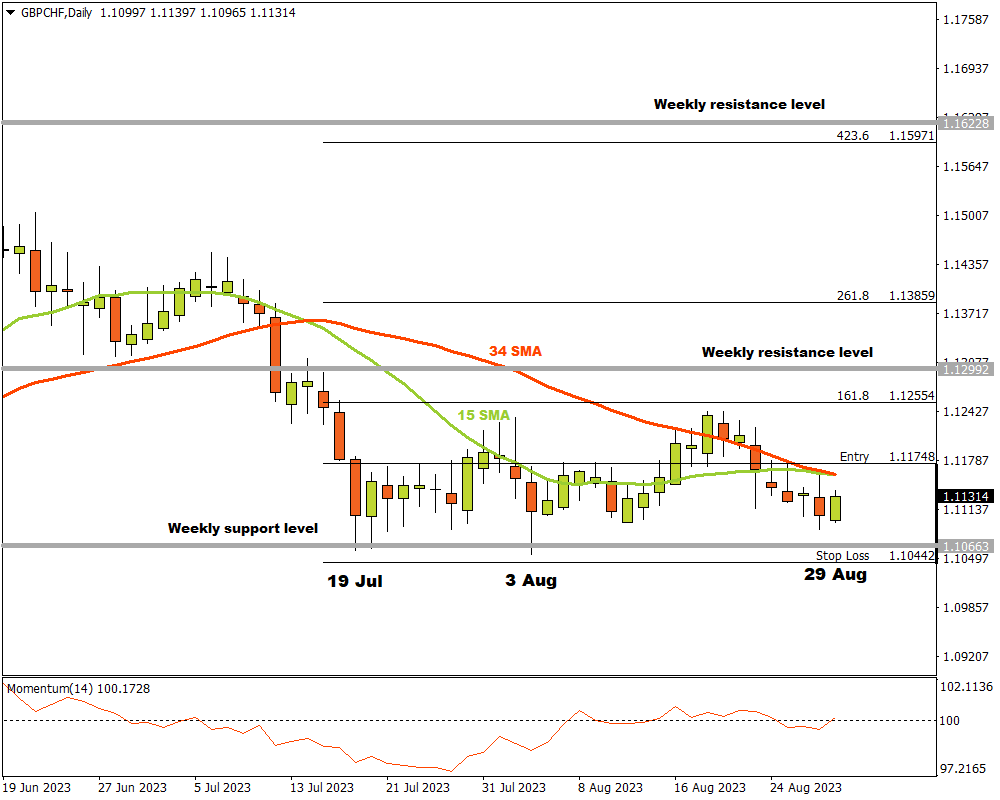

- GBPCHF breaking above 1.11748 may send bullish signal

- Three potential targets identified

- If 1.10442 support is broken, bullish scenario becomes invalid

Rising tops and bottoms should keep GBPCHF bulls in play, pending any news that might cause market structural changes.

The bears on the GBPCHF currency pair on the D1 time frame have been testing a weekly support level from 19 July right through to 29 August. The bulls held their ground however and the support has never been properly breached.

Possible confirmation for a bullish attempt to break to upside has been mounting with the 15 and 34 Simple Moving Averages edging together and at an overlap at this moment. The Momentum Oscillator has also broken into bullish territory and has been toeing the line from 3 August.

If the market manages to break past the last bearish candle, which had wicks to both sides, thus indicating possible indecision, then three price targets can be calculated from there.

If the bears interfere at any time and succeed in breaking through the weekly support level at 1.10442, this will invalidate the long setup on the GBPCHF currency pair and risk must be managed very carefully from there.

Attaching the Fibonacci tool to the 1.11748 price level and dragging it to just below the lowest test of the weekly support level at 1.10442, the following targets can be established:

- The first target is possible at 1.12554 (161.8) that is located just before a weekly resistance level

- The second price target is likely at 1.13859 (261.8)

- The third price and final target is probable at 1.15971 (423.6) if the bulls can press in and reach the next weekly resistance level

Latest reviews

There's a better website for you

A new exciting website with services that better suit your location has recently launched!

Sign up here to collect your 30% Welcome Bonus.