Gold holds support at the 100-day Simple Moving Average

Gold enjoyed its best day in five weeks as buyers pushed prices up by 1.3% on the day. Yesterday saw softer than expected US data which cooled Fed rate bets and unwound some recent hike pricing. The weekly jobless claims spiked higher to levels not seen since October 2021 which caased the dollar and US Treasury yields to tumble.

Of course, this is like nectar for gold bugs after earlier weakness in the week as central banks like the RBA and Bank of Canada both surprised markets with more rate hikes. While there are potentially more priced in by futures markets for those central banks, the Fed is fully expected to pause at its meeting next week with a July rate rise more likely before one cut later in the year.

Interestingly, the latest data from the People’s Bank of China (PBoC) shows that China increased its gold reserves for a seventh straight month amid ongoing strong demand for safe assets among central banks. This does suggest an underpinning of support for the yellow metal from central banks.

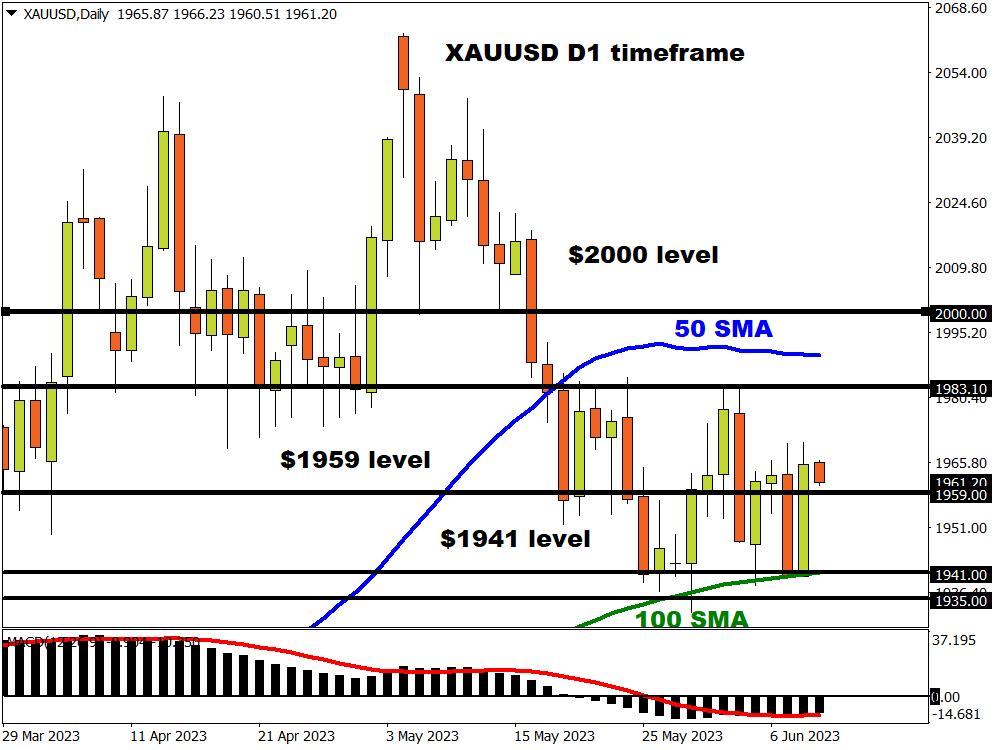

Technically, gold still just about remains in a long-term bullish channel from the October 2022 lows. The 100-day moving average at $1941 has acted a strong support in recent sessions and also capped the downside earlier this year. Below here is the halfway point of March rally at $1935. Prices are now trading just above the February high at $1959 as traders look towards the US CPI next Tuesday as a key driver ahead of the Fed meeting.

Latest reviews

There's a better website for you

A new exciting website with services that better suit your location has recently launched!

Sign up here to collect your 30% Welcome Bonus.