Gold rebounds after making a three-month low

It’s been a super-eventful week for markets with major central bank meetings to digest as well as a lot of ecoonmic data releases. The FOMC meeting brought a more hawkish tilt to the rates outlook with the dot plot indicating two more 25bp rate hikes in the coming months. That said, Chair Powell was more cautious in his words and language at his press conference. Policymakers will remain data dependent and judge decisions on a meeting-by-meeting basis. Interestingly, money markets actually only price in a July hike at 72% with the risk of an incoming recession forcing a change in tone after this date.

Some of that data has been weaker this week including PPI data on Wednesday which provided more hints of easing pipeline pressures, mixed retail sales and manufacturing data that failed to offer a clear steer. A rising trajectory in the weekly jobless claims took hold last month and yesterday’s four-week high print is sending a signal that the economy is slding into recession. Crucially, US Treasury yields came off their highs on Thursday.

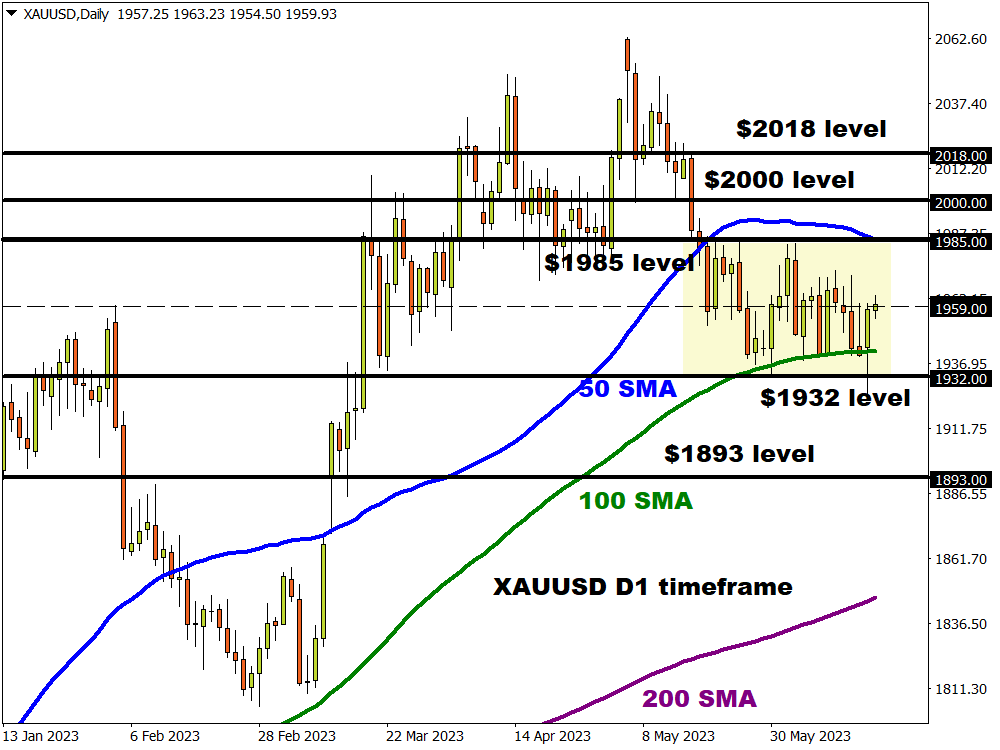

The further delaying of a peak rate scenario has seen total ETF holdings drop continuously for the past 12 trading sessions. Gold is a non-yielding asset so sees sellers when interest rates rise. But if markets are right and we are now very close to the top in rates, then then gold bugs will be more content. Yesterday saw the precious metal sink to $1925 and levels last seen in mid-March before closing strongly at $1958. Gold had traded in a relatively tight range since mid-May between $1985 and $1932. Below the bottom of that range, traders will be looking for support at $1893. This is a Fib level (38.2%) of the November 2022 uptrend. Resistance resides at $1959, the early February swing high and the outside of the long-term bull channel.

Latest reviews

There's a better website for you

A new exciting website with services that better suit your location has recently launched!

Sign up here to collect your 30% Welcome Bonus.