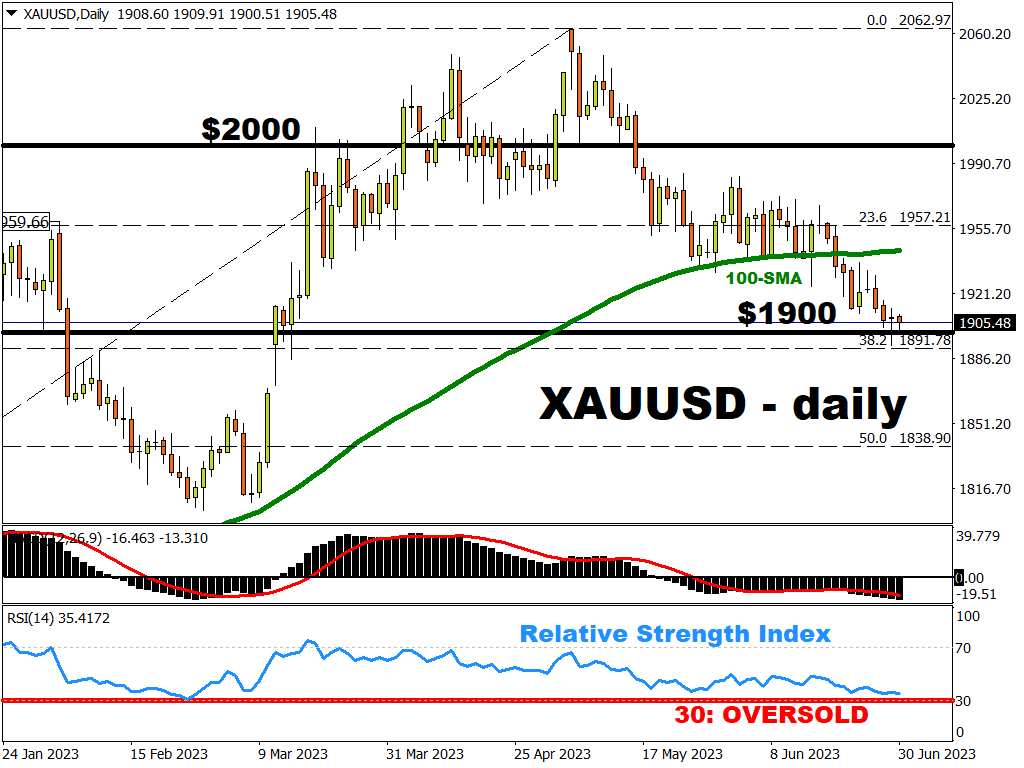

Gold looks headed for sub-$1900 levels

Gold is set to post its third consecutive weekly drop, even temporarily slipping into sub-$1900 domain, as robust US GDP and jobs data this week point to further Fed rate hikes in the months ahead.

From a technical perspective, spot gold has yet to officially break into “oversold” territory, with its 14-day relative strength index (RSI) yet to hit the 30 threshold.

That suggests that spot gold may yet dip once more below $1900 over the coming sessions.

Despite still holding on to a year-to-date advance of over 4%, zero-yielding bullion’s lustre has drastically waned in recent months as markets brace for higher-for-longer US rates.

Markets have ramped up expectations for a Fed rate hike in July, while also now projecting a 45% chance of an additional 25-bps hike by November.

A daily close below the psychologically-important $1900 should cause bullion bulls’ shoulders to slump even more.

As long as the Fed keeps its benchmark rates well above 5% and delays the prospects of a rate cut, that should extend the wait for bullion bulls before prices can see a meaningful recovery, barring any sudden spike in geopolitical tensions or recession fears in the interim.

Latest reviews

There's a better website for you

A new exciting website with services that better suit your location has recently launched!

Sign up here to collect your 30% Welcome Bonus.