UK Index suffering as policy tightening looms

We’ve had plenty of data to watch over the last few days in the UK with job numbers and the all-important inflation figures hitting our screens this week, while retail sales wrap up the mid-month deluge.

The Bank of England doesn’t meet until late September before which we get another set of this data.

But markets have baked in another 25bps rate hike in a few weeks’ time, with two more quarter-point moves predicted by February next year.

The September odds have been cemented by yesterday’s CPI with the headline falling but still more than three times the Bank of England’s 2% target.

Crucially, the core measure, which strips out volatile food and energy costs, remained unchanged at 6.9% while core services ticked up to 7.2%. These gauges are a key focus for policymakers as they highlight that underlying price pressures are still sticky.

Along with relatively hot wage growth released on Tuesday (we note the jobless rate did tick up above 4%), there are renewed expectations on the BoE to keep raising rates even though policy is now seen as restrictive.

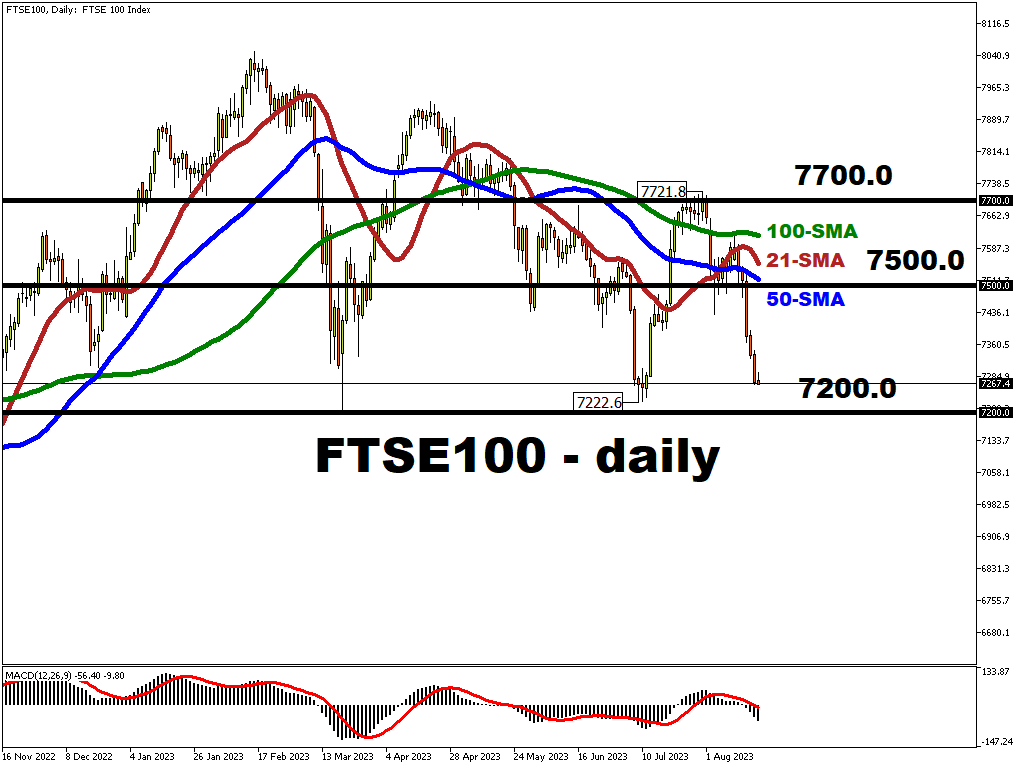

FTSE 100 summer doldrums

The UK’s main index has dropped close to 400 points or 5% in the matter of three weeks. This comes on the back of it failing to keep up with other major global stock indices this year.

The FTSE 100 just about finished the first half in the green., but compare that to the Nasdaq’s 32% gain, the S&P 500 moving 16% higher and the Dax adding 14%.

The index is made up of interest rate sensitive stocks like banks, homebuilders, and insurers which means stubborn CPI and rising interest rates have been a big drag. The current theme of higher rates for longer will also impact.

Add oil majors, energy and mining companies to the mix and it is not hard to see why there has been underperformance. This is especially due to the lack of tech stocks which have fuelled the US rally.

A majority of these big-cap stocks also derive their earnings from overseas.

That means a relatively strong pound will potentially hurt their results going forward. Prices recently fell below the midpoint of the October rally from last year at 7377.8. The index has only dropped below here briefly on two occasions this year, in March and July.

If buyers do step in, they will aim for 7500 with the 50-day simple moving average just above at 7513. That said, momentum indicators are not oversold so shorts may target the July lows and the March spike trough above and below 7200.

Latest reviews

There's a better website for you

A new exciting website with services that better suit your location has recently launched!

Sign up here to collect your 30% Welcome Bonus.