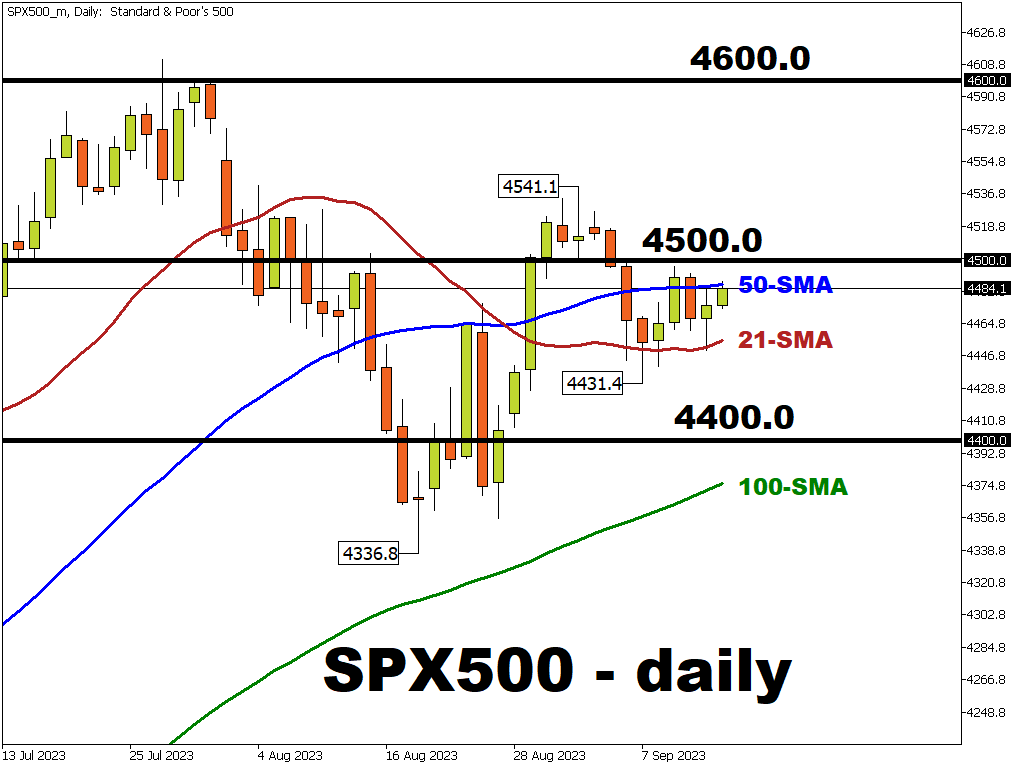

SPX500_m still in limbo below 4500.

The S&P 500 has remained relatively unchanged, consolidating further in between the 21-period SMA & its 50-day counterpart.

The benchmark US stock index has found it hard to resurface above the psychologically-important 4500, as markets are still assessing whether yesterday’s CPI reading would keep the Fed on the hawkish trajectory.

The August consumer price index (CPI) increased to 3.7% year-on-year (vs 3.6% expected) while the core CPI month-on-month (August vs. July 2023) grew 0.3%, slightly higher than the expected 0.2%.

This was the first uptick in the core CPI MoM reading since February.

Despite an increase in consumer prices, the market expects a 97% chance of no rate hike at the Fed’s meeting next Wednesday.

And while the markets seem confident about a “no hike” scenario at the upcoming Fed’s decision next week, investors will pay a very close attention to any further macro-economic developments with a potential to reaffirm one more hike in November.

For the moment, the market expects a 39% chance of a rate hike at the Fed’s meeting in November.

From a technical perspective the 50-period SMA is set to act as an immediate resistance at 4487.

To the downside, the 21-period SMA might prove to be a strong support level if the SPX500_m bears gain enough momentum to reverse towards psychologically important 4400, with a potential pit stop at last Thursday’s (September 7th) Intraday low of 4431.4.

Latest reviews

There's a better website for you

A new exciting website with services that better suit your location has recently launched!

Sign up here to collect your 30% Welcome Bonus.