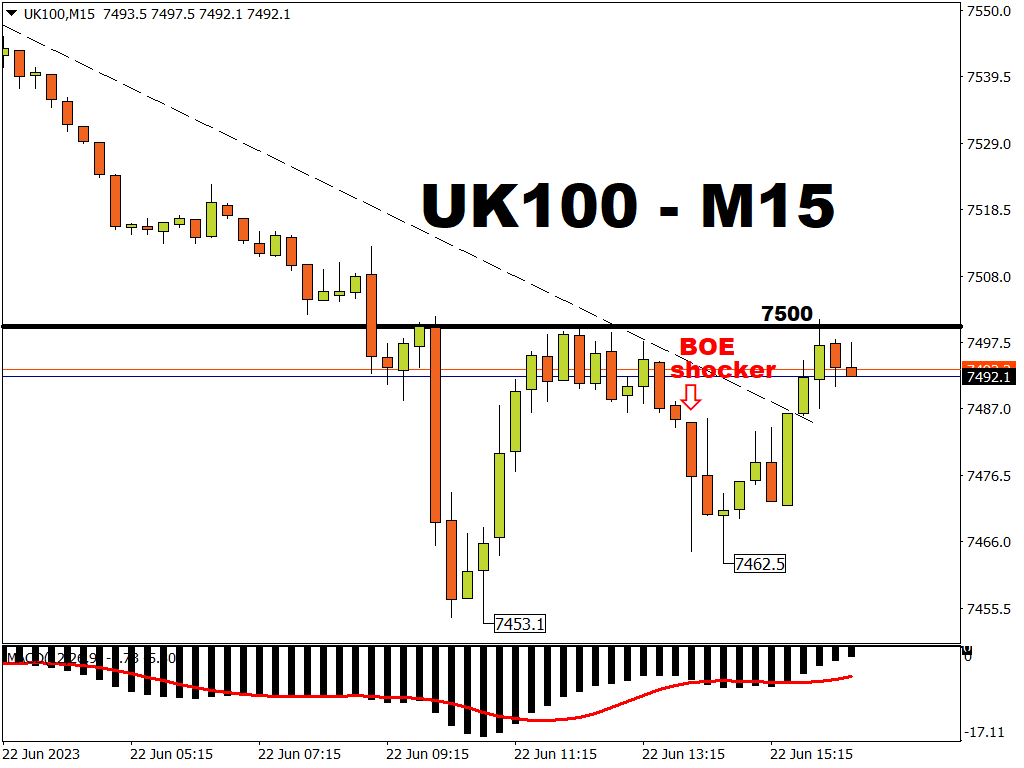

UK100 recovers after BOE shocker

The Bank of England (BOE) surprised markets with an aggressive hike of 50 basis points (bps) just hours ago.

That 50bps hike is double the size of the 25-bps hike that markets had predicted.

Today’s policy decision now raises the BOE’s benchmark interest rate to 5%; its highest level since 2008!

The unexpected move is just the latest show of aggressiveness by a major central bank has further sapped the rally from equities, which are seeing declines across developed markets.

How did markets react?

The immediate knee-jerk reaction for the UK100, and even GBPUSD, played out as expected:

- A larger-than-expected rate hike would typically trigger currency gains. GBPUSD duly spiked past the 1.2800 level.

- And given the FTSE 100’s inverse relationship with Sterling, the UK100 index (which tracks the underlying benchmark FTSE 100 index) moved lower following the BOE shocker.

However, once markets had more time to digest the central bank’s shocker, the UK’s benchmark stock index duly erased losses following the central bank’s shocker.

Such price action suggests that fears for a looming UK recession have been ramped up by today’s BOE’s policy decision.

After all, the central bank’s rationale for lifting interest rates higher is to “destroy” demand in the economy.

Hence, the knee-jerk spike higher for GBPUSD failed to stick at the time of writing, which in turn allowed the UK100 index to erase its losses, at least for now.

What’s next for the BOE?

Over time, we will learn just how much higher the BOE will raise interest rates.

At the time of writing, markets are fully expecting another 100bps in rate hikes by the BOE before end-2023.

There’s even a 35% chance being accorded to a total of 125bps in BOE hikes by February 2024.

In the meantime, markets will be eager to watch just how well the UK economy can withstand these rate hikes, and whether inflation duly subsides in response.

What’s next for the UK100 index?

The benchmark UK stock index could be restored to recent heights if:

- GBP unwinds more of its recent gains

- UK inflation subsides, BOE isn’t forced to keep hiking much further with a UK recession looming large

However, the UK100 may be dragged even lower if:

- GBP resumes its ascent

- UK inflation proves stubborn, forcing more BOE hikes while the UK economy proves resilient

Latest reviews

There's a better website for you

A new exciting website with services that better suit your location has recently launched!

Sign up here to collect your 30% Welcome Bonus.