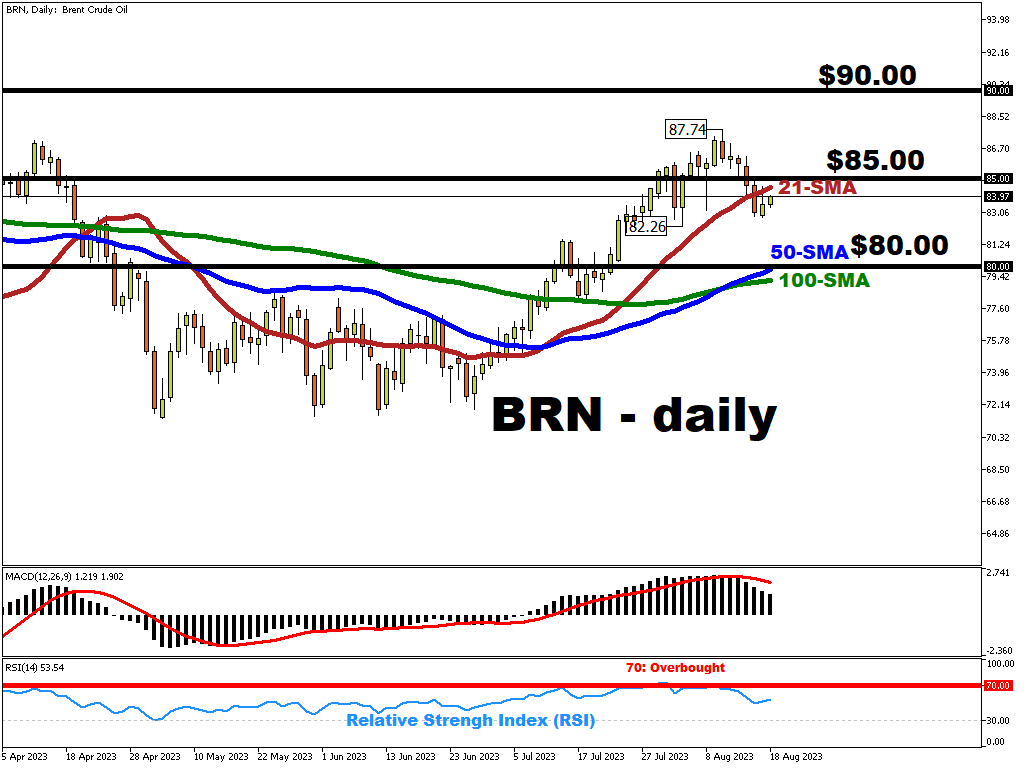

BRN downturn below $85.00/bbl

After hitting a 7-month high at $87.74 last week, BRN bears have retaliated and pushed the price back below the $85.00 round number.

Due to recent data suggesting an economic slowdown, looming concerns over a potential drop in demand from China, the world’s number one oil consumer, are intensifying the bearish trend. This has been amplified by the strengthening US dollar in the face of possible further policy tightening by the Fed.

Brent is now trading under the 21-SMA for the first time since the beginning of June, but is trying to push back above $85.00/bbl.

Core macro-economic data regarding the direction of the Chinese economy and the Fed’s stance at its September meeting will have a major effect on whether the BRN will be able to return and stay above $85.00/bbl. Fed Chair Powell is also speaking next week at the Jackson Hole symposium which has been a major risk event in the past.

The 21-day SMA is set to offer near-term resistance, while the Relative Strength Index (RSI) is roughly midway between the upper (70 – overbought) and the lower (30 – oversold) boundary which confirms the market’s current state of “uncertainty”.

Latest reviews

There's a better website for you

A new exciting website with services that better suit your location has recently launched!

Sign up here to collect your 30% Welcome Bonus.