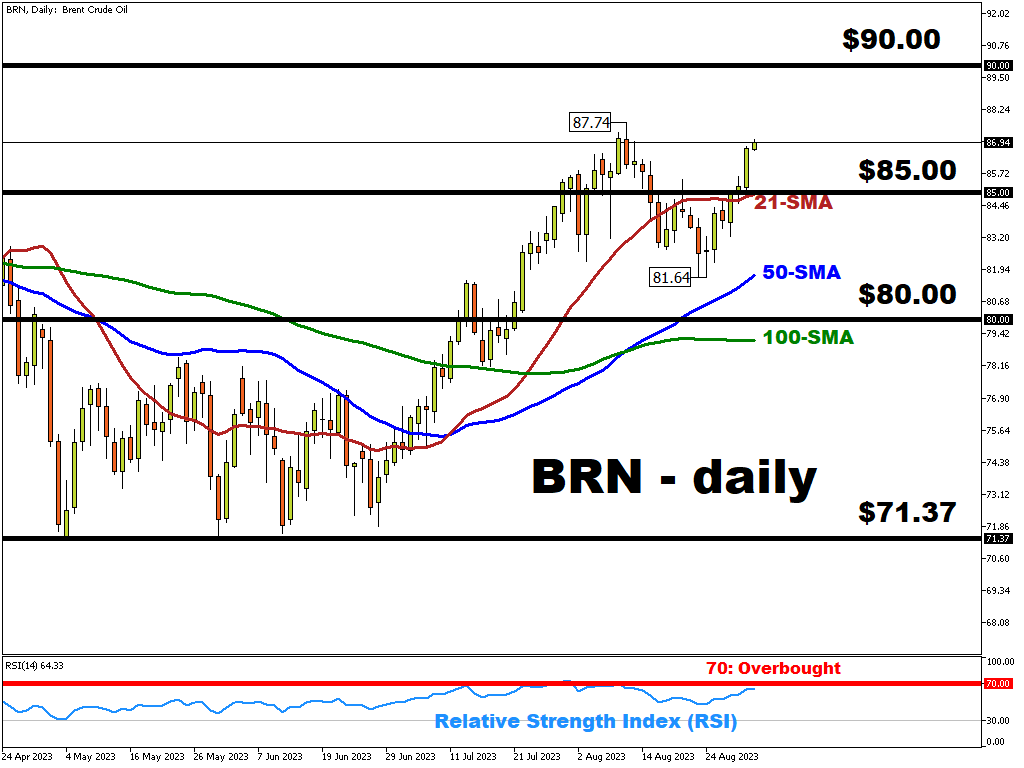

Brent is trying to hold above $85.00/bbl

Brent is trying to hold on above $85.00/bbl as markets expect OPEC+ cuts to be further extended, offsetting a potential slowdown in demand from China. In addition to the wider OPEC+ supply limit, Saudi Arabia might also prolong it’s voluntary 1 billion bbl/day output cut.

Analysts are expecting crude to average $82.45/bbl in 2023.

But the struggling Chinese economic recovery is playing a key role in determining potential future demand for oil. Investors are also paying close attention to the US, still a leading oil consumer, ahead of the Federal Reserve’s interest rate decision in September.

The Fed’s continuation of its hawkish bias may strongly impact on the demand for “black gold”.

From a technical perspective, $86 could provide support, while the Relative Strength Index (RSI) is still a few levels lower than the upper boundary (>70 denotes overbought territory), indicating potential for further upside.

Latest reviews

There's a better website for you

A new exciting website with services that better suit your location has recently launched!

Sign up here to collect your 30% Welcome Bonus.