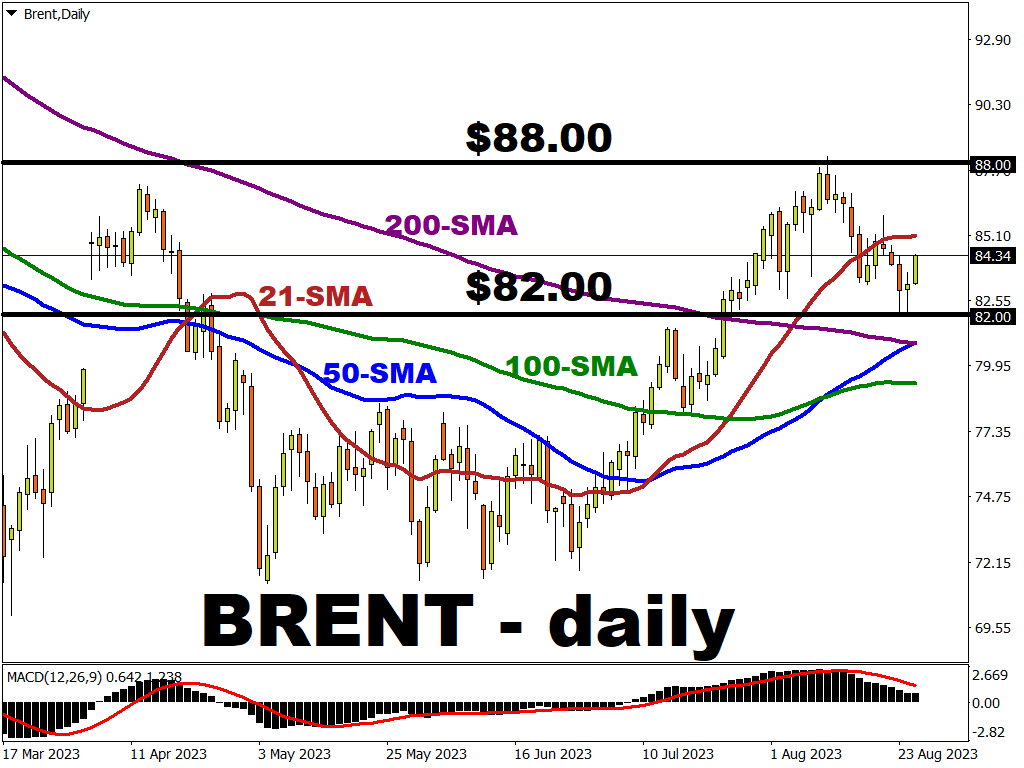

Will “golden cross” be enough to save the BRENT?

Oil prices continue to climb away from the $82.00 round number, aided by news today of China’s support for its ailing economy.

Traders may have also read a bullish sign from the “golden cross” formation - when a lower – 50-period SMA crosses above the higher – 200-period SMA.

The last time the “golden cross” formation could be seen within BRENT – daily chart was in late-September 2020.

After the last “golden cross”, BRENT bulls have managed to propel the price by more than 200% up to around $130/bbl.

But despite this positive technical outlook, oil prices may remain under a significant pressure due to:

- Venezuela, holding the world’s largest crude oil reserves, temporarily regaining access to the global oil market as US is considering a “short-term” lift of it’s previously imposed sanctions.

- Record surge, in almost a decade, of Iranian oil exports to China as China continues to enjoy the discounted prices from it’s heavily-sanctioned “trading partner”.

- Looming uncertainty over the future of the Chinese economy (China – world’s largest crude oil importer) partially fuelled by its troubled property sector. The highly-anticipated speech by Fed Chair Jerome Powell at Jackson Hole later today may well set a major tone as investors are seeking clues on future interest rate policies by the Fed.

A confirmed still-hawkish stance on the future interest rate hikes in the US may add additional pressure on BRENT, with a potential for it to move below $80.00/bbl.

Latest reviews

There's a better website for you

A new exciting website with services that better suit your location has recently launched!

Sign up here to collect your 30% Welcome Bonus.